Going-concern appraisals vs. business valuations

Canadian Property Valuation Magazine

Search the Library Online

Going-concern appraisals vs. business valuations

By JT Dhoot, AACI, CBV

Omnis Valuations & Advisory Ltd

Real property appraisers often value special-use properties, hotels and seniors care facilities, to name a few, on a going-concern basis. The term ‘going-concern’ is not defined in the Canadian Uniform Standards of Professional Practice (CUSPAP), although it is defined in The Appraisal of Real Estate, 3rd Edition, wherein the definition is: “All tangible and intangible assets of an established and operating business with an indefinite life.”[1]

According to the Canadian Institute of Chartered Business Valuators (CICBV), the definition of ‘going-concern value’ is: “The value of a business enterprise that is expected to continue to operate into the future. The intangible elements of going concern value result from factors such as having a trained work force, an operational plant, and the necessary licenses, systems, and procedures in place.”[2]

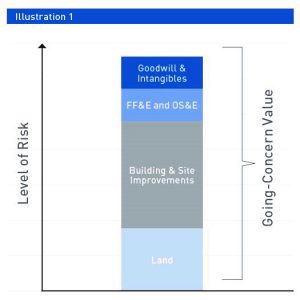

In the context of real estate appraisal, the going-concern value of a property is effectively the sum of the value attributed to; 1) land; 2) building and site improvements; 3) furniture, fixtures, and equipment (FF&E) and operating supplies and equipment (OS&E); and 4) goodwill and intangibles, if any. Each of these components of value is characterized by a different risk-return profile, as depicted in Illustration 1.

Members of the Appraisal Institute of Canada (AIC) are trained to value tangible assets such as land and buildings, with some Members expanding their scope of expertise to include the valuation of machinery and equipment. In certain situations, the value of a going-concern business (or holding company) may require the expertise of more than one valuation professional (i.e., real estate appraiser, equipment appraiser, and/or business valuator). When this is the case, it is critical that each of the valuators understands the terms of reference (i.e., effective date of valuation, intended use, scope of work, etc.) in order to ensure that the overall value of the subject asset (or other interest such as shares, partnership units, etc.) is calculated in a consistent manner. A brief summary of the similarities and differences between going-concern real estate appraisals completed by Members of the AIC and going-concern business valuations completed by members of the CICBV is provided below:

- Definition of Value

There are subtle differences in the most commonly used value term in real estate appraisal vs. business valuation, as follows:

| Organization | Canadian Institute of Chartered Business Valuators | Appraisal Institute of Canada |

| Value Term | Fair Market Value | Market Value |

| Definition | “The highest price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arms-length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.”[3] | “The most probable price, as of a specified date, in cash, or in terms equivalent to cash, or in other precisely revealed terms, for which the specified property rights should sell after reasonable exposure in a competitive market under all conditions requisite to a fair sale, with the buyer and seller each acting prudently, knowledgeably, and for self-interest, and assuming that neither is under undue duress.”[4] |

Dissimilarities include the practice of using ‘fair market value’ vs. ‘market value,’ using ‘the highest price’ vs. ‘the most probable price,’ and affixing the term ‘hypothetical’ prior to the use of the term ‘buyer’ or ‘seller.’ All in all, these subtle differences result in the business valuator stressing the importance of some factors (i.e., notional market, price vs. value, special-interest purchasers, etc.) that may not be addressed explicitly in a real estate appraisal.

- Enterprise Value vs. Equity Value

The appraisal of residential and commercial real estate is often completed on an all-cash basis (i.e., before debt). In a business valuation context, this is considered analogous to the term ‘enterprise value,’ which is defined as”The total value of a business including both its interest-bearing debt and equity components.”[5]

- Before vs. After-Tax

The appraisal of real property is completed on a before-tax basis, whereas a business valuation is undertaken on an after-tax basis. The circumstances of the engagement will dictate if the business valuator deducts corporate taxes, personal taxes, or both.

With respect to tax calculations, it is important for real estate appraisers to be cognizant of the fact that land is not considered depreciable property for the purpose of deducting capital cost allowance (CCA). Conversely, most buildings and equipment are depreciable property and, therefore, business valuations generally consider these prospective tax savings, which are known as the ‘tax shield.’

- Assets vs. Shares

Real estate appraisal generally assumes an asset transaction (unencumbered by debt), whereas business valuation generally implies a share transaction, although asset transactions involving business interests are also common. In addition to tax and legal implications involved in the valuation of assets vs. shares, appraisers should also remember the valuation of shares (common equity, preferred equity, or perhaps both) involves solving for equity value, which therefore requires consideration of any outstanding debt.

- Redundant Assets

Redundant assets are defined as “Assets not necessary to ongoing operations of the business enterprise.”[6] In the context of real estate appraisal, the concept of a redundant asset can be considered similar to the concept of surplus land.

Summary

A brief summary of the issues presented in this article are summarized below.

| Business Valuation Report by a Member of the CICBV | Real Estate Appraisal by a Member of the AIC | |

| Definition of Value | Fair Market Value | Market Value |

| Professional Reporting Standard | Practice Standards (Standard No. 110) | Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) |

| Type of Report | Narrative (Calculation, Estimate, or Comprehensive Report) | Full Narrative (typically) |

| Ownership Interest | Varies | Typically 100% |

| Treatment of Debt | Enterprise Value = Before-Debt Equity Value = After-Debt | Before-Debt (typically) |

| Asset vs. Share | Asset or Shares | Asset |

| Income Tax | After-Tax | Before-Tax |

| Redundant Assets | Excess working capital and other capital assets may be considered redundant | Surplus land and other redundant assets are considered |

Members of the AIC who are trained to perform going-concern valuations can benefit from understanding the nuances between property appraisals and business valuations. Although there may be differences in how a going-concern value is derived by an appraiser vs. a business valuator, both disciplines share the same concepts that are fundamental to valuation theory:

- Value is constantly changing and, therefore, any value conclusion is only valid as at a specific point in time;

- Value is forward looking, meaning past events are only relevant to the extent they provide an indication of future prospects; and

- The value of an asset is equal to the anticipated benefits to be received in the future after these benefits are discounted to present value on a risk-adjusted basis.

In the end, both property appraisers and business valuators play an important role in going-concern valuations. In some cases, both of these professionals are needed to arrive at a credible opinion of value.

End notes

[1] The Appraisal of Real Estate, 3rd Edition, Editor: Larry Dybvig, Appraisal Institute of Canada, c2010, page 2.14

2 The International Glossary of Business Valuation Terms

(https://cicbv.ca/wp-content/uploads/2010/10/Practice-Bulletin-No-2-E-2001.pdf)

3 The International Glossary of Business Valuation Terms

(https://cicbv.ca/wp-content/uploads/2010/10/Practice-Bulletin-No-2-E-2001.pdf)

4 Canadian Uniform Standards of Professional Appraisal Practice, Effective January 1, 2018, page 72 of 120

5 The Valuation of Business Interests. Campbell, Ian R. and Johnson, Howard E., Canadian Institute of Chartered Accountants, c2001.

6 The International Glossary of Business Valuation Terms

(https://cicbv.ca/wp-content/uploads/2010/10/Practice-Bulletin-No-2-E-2001.pdf)