Closing Tech Gap

Canadian Property Valuation Magazine

Search the Library Online

Commercial real estate (CRE) has traditionally lagged other industries in technology investment, but this is all set to change

By Colin B. Johnston, AACI, P. App., who leads Altus Group’s valuation practice nationally, including Altus’ 300 appraisers and consultants across Canada. During his 20+ years with Altus, Colin has become one of the country’s pre-eminent valuation and advisory professionals, with a particular emphasis on investment-grade retail assets.

Developers and owners spend billions every year on future proofing their CRE assets by using the best materials, improving their sustainability or through cutting edge smart building devices designed to appeal to demanding occupiers.

For an industry that can deliver stunning developments through ambitious and cutting-edge construction techniques funded by highly innovative financing models, it appears to be somewhat of a disconnect to see the CRE world’s low levels of investment in IT spending, particularly in understanding the performance of assets. For decades, the CRE industry has largely been underweight in its investments in technology when compared to other industries. As a percentage of overall revenue, CRE spends roughly half on IT infrastructure than the financial services and infrastructure industries.[1]

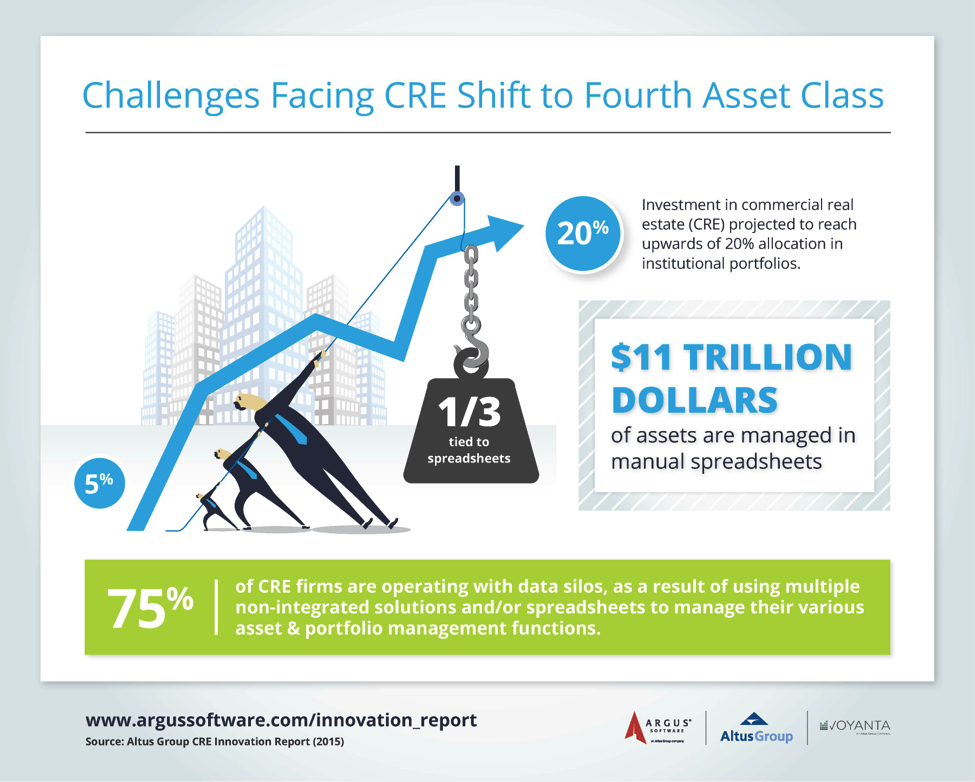

For years this has sufficed, especially when CRE was considered as an ‘alternative’ investment. However with institutional allocations to the sector increasing year on year, CRE has firmly arrived as the ‘fourth asset class’ alongside equities, bonds and cash. The numbers bear this story out. Only 20 years ago, CRE would receive a portion of institutional capital’s approximate 5% allocation to alternatives. Today, the target allocation for CRE assets stands at 9.67% (representing US$6.7 trillion) and some estimates, including those of PWC, have proposed that it could double and stabilize at around a 20% allocation in institutional portfolios. [2]

CRE’s new position as the fourth asset class has brought great opportunities to our industry, but also far greater expectations from investors in not only performance, but, crucially, in increased transparency and reporting. Recognizing that it is a much less liquid asset class than stocks, bonds and cash, the shift of CRE to a mainstream investment class means investors want clarity, transparency and real-time data.

These increased investor needs seem at odds with the findings of the recent Altus Group Innovation Report in which 300 CRE executives, representing over $1 trillion in assets under management, were interviewed on how they are currently using technology. The results demonstrated that over 1/3 of companies are still using manual spreadsheets as their primary asset management tool. This means there are potentially $11 trillion of CRE assets being currently managed in spreadsheets with all their inherent risk of inefficiencies and human error.

Investors raised on a diet of instant access to information on their investments in shares, bonds and equities have little appetite for manual spreadsheet-based calculations and forecasting, which require significant manpower to make updates on the latest rates, rents or cap rates. CRE executives must, therefore, meet the needs of these investors who operate with the expectation of on-demand information delivery – they want better data, more of it, and more often.

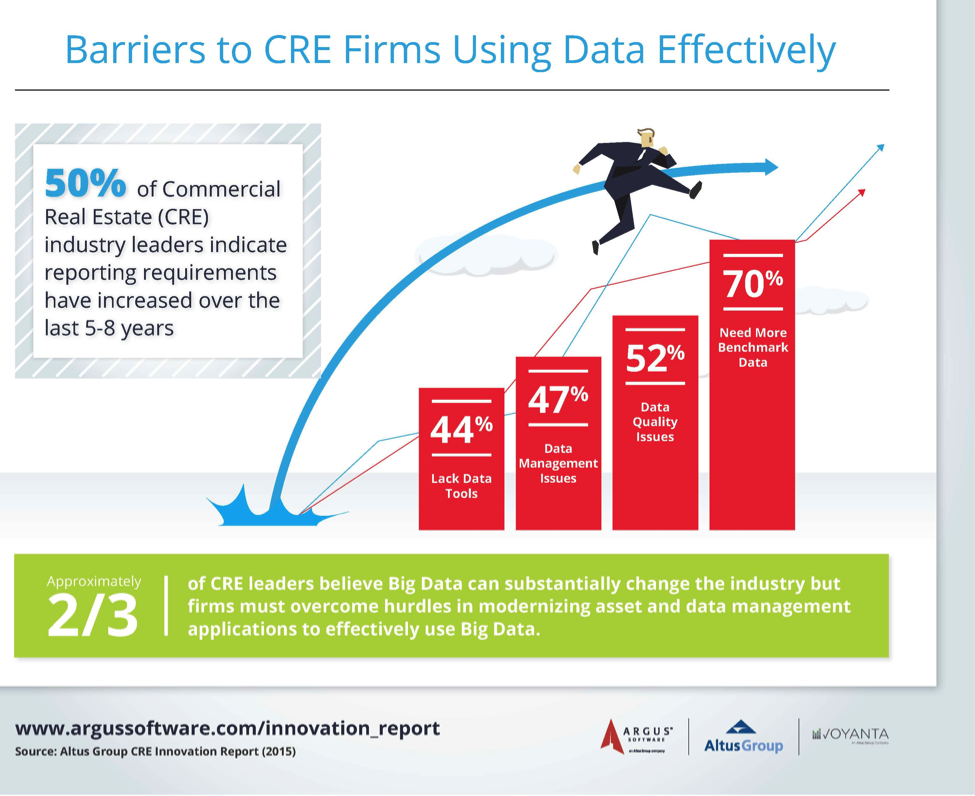

What is also extremely clear from the results of the report is that there is a clear desire among CRE firms to consume and digest more data to make more informed investment and portfolio decisions:

- 70% of the firms surveyed feel they either need more data or additional metrics to benchmark their performance against the market.

- More than two thirds of those surveyed believe they could achieve a significant impact on their investment returns, if they improved their asset and portfolio management decision-making process.

This desire for additional data around the performance of assets should be wholeheartedly welcomed by the valuation community and is something that is increasingly being asked for by our clients. Despite CRE’s slow adoption of technology, both the report and our own conversations with clients are telling us that the tide is changing and that a concerted effort to close CRE’s technology gap is gaining traction amongst firms. 77% of CRE executives that were interviewed stated that investment in technology was a ‘substantial priority’ for their firm, telling us that the majority of the industry is taking this issue extremely seriously.

The want for more data is patent, and it appears that CRE companies now seem prepared to invest accordingly, but CRE firms are struggling with how to collect, centralize and verify this data. In fact, over half of the respondents to our survey were concerned about the veracity of the data they are working with. That is, they are indicating that they are not fully confident in the accuracy of what is being reported about their portfolios – a clearly worrying trend for valuers.

From our research, the lack of centralized data seems to affect the majority of the CRE industry with over three-quarters of the surveyed firms operating in ‘data silos.’ On a practical note, this means that it can take weeks or even months to generate an overall assessment of a company’s total portfolio due to manually aggregating data from multiples sources. An integrated platform allows you to see this top-level information in real-time and having this at your fingertips allows you to analyze changes in market conditions quickly and to make better-informed strategic investment decisions.

Although CRE clearly operates on a far longer timeframe than other industries, with its long-term leases and multi-year development projects, it is not immune from macro-shocks that can quickly change market sentiment. One only has to look at the abrupt departure of Target from Canada this past spring to understand how these shocks can affect market sentiment almost overnight. Canada’s retail outlook went from buoyant – toasting the arrival of a lineup of new foreign retailers – to grappling with a 15-million square foot black hole of space coming back on the market imminently. In this situation, landlords who possess a centralized software system that allows them to quickly roll up their portfolio, ascertain their exposure and then apply sensitivity analysis and reforecast have a distinct advantage to those owners where this process might take weeks through aggregating various spreadsheets and data in different formats.

The emergence of products such as Voyanta, which help CRE firms aggregate, centralize and improve the veracity of data, shows there is a clear demand to improve data management processes. If we can get this right, the potential for the industry is enormous. Not only will it improve transparency, increasing the liquidity of assets and improving the rating of CRE as an asset class, but it opens up the door to harness the power of Big Data, which 2/3rds of surveyed CRE executives believe has the potential to “transform the industry.”

Currently, CRE companies are generating a large amount of data through multiple sources – internal and external – such as market data, tenant property use through security passes and customer information generated through social media. Capturing, storing, and analyzing large sets of structured and unstructured big data appropriately and in real time can be used to identify business trends and opportunities. While this sounds simple, having the appropriate technology is critical to derive maximum benefits from large sets of data. As our research shows, data commonly resides in multiple, disparate systems – inside and beyond the firewall – which makes it difficult to conduct meaningful analysis. However, before CRE can begin to even think about realizing the business benefits associated with Big Data analytics, it first needs to lay the technological foundations from which to build.

Improved transparency

For valuers, perhaps the most exciting improvement that investing in technology can bring is improvement to transparency in a market that many outsiders still consider as opaque. We should not forget the significant role that real estate and CMBS in particular had in the financial crisis of 2008. The global recession focused many shareholders’ minds on the need for increased reporting, transparency and detail. The results of our survey also point to this trend, with over half of CRE executives stating that investors now require not only more frequent reporting, but in more detail and in more standardized formats.

By embracing technology and allowing investors access to real-time and up-to-date KPIs, this improved transparency will bring additional liquidity to the market and assets. As real estate becomes ever increasingly globalized, having additional data allows firms to confidently enter new markets by giving investors assurance they have the appropriate information to make accurate decisions.

Alongside increased transparency, the need for international valuation standards would also be a boon to liquidity in CRE markets. We have seen Canadian firms, especially our institutional capital, lead the way in terms of cross-border investment over the last few years. As the demand for core-plus assets has increased, yields have compressed and investors have started to look further afield to meet return targets. This has led to some companies having to enter new markets based on imperfect information. With improved transparency and standardized valuation, global CRE firms will be able to compare the performance of assets on a like-for-like basis, opening up emerging markets for new sources of capital. Our job as valuers will be to support our clients through this process. As they ramp up their international activities, it is important that we remain in lockstep.

The CRE industry’s relationship with technology is clearly changing and there are tangible benefits for the industry as a whole, but, in particular, for early adopters as a point of differentiation. The valuation community in Canada itself needs to make sure we are at the forefront of these changes so we can ensure that we are providing our clients with the right data, at the right speed and in the right formats to allow seamless integration with their own technology platforms.

References

[1] Source: Service Innovation: Spending Metrics – IT Spending by Sector, IDC January 2015

2 Source: Institutional Real Estate Allocations Monitor, Funk, D., & Weill, D., Cornell University’s Baker Program in Real Estate and Hodes Weill & Associates, LP, September 2014.