Easements and agricultural land values revisited

Canadian Property Valuation Magazine

Search the Library Online

By David Enns, AACI

Easements and right-of-ways

Easements represent an interest in real property that is less than fee simple ownership. An easement is defined as a right acquired by an individual (or a group or a corporation) to use someone else’s land for a special or particular purpose. While they can be created for a number of reasons, they often involve pipelines, pole lines, or drainage ditches. A right-of-way is a particular type of easement that grants an individual (or a group) the right or the privilege to pass over the land of another. Usually, but not always, the right-of-way (as with other easements), takes the form of a strip of land with clearly defined boundaries. 1

Easements can certainly impact property values. A single easement or several easements over a tract of land can limit or eliminate the choice of building sites and, thus, have a negative affect on a property’s market value. Easements for pipelines and power lines can be contencious, for reasons far beyond a right of use, as we saw with Canada’s proposed Keystone pipeline running through Nebraska.

Our interest here, however, is the effect on the market value of farmland that is subject to an easement. Property owners are compensated for the loss of rights associated with the granting of an easement, but do they really affect the market value of such a property?

Background

Some time ago, an article was published in Canadian Appraiser magazine that dealt with the issue of power line and pipeline easements and their effect on the market value of agricultural farmland. 2

In that article, it was observed that, if these easements were to negatively affect market value at the time of easement acquisition, then they should do so at the time of resale. If that is the case, then apprasiers should make adjustments when conducting appraisals on properties that are subject to such easements. Indeed, Appraisal Standard Rule 6.2.9 of CUSPAP requires that appraisers consider the effect of easements, as they might affect market value.3

One conclusion in that article, based on a number of sales of farmland in Lancaster Township (Glengarry County, Ont.), was that vacant farmland subject to such easements does not suffer a negative effect on market value.

The method used to support that conclusion was an examination of sales of vacant (tile drained) farmland both with and without such easements.

Paired sales and market evidence

In a perfect world, a generous number of paired sales 4 would be the best market evidence to draw such a conclusion, however, the sales used in that study were not truly ‘paired sales.’ Paired sales involve the sale of two properties whose characteristics are highly similar. The only difference between them is the passage of time. Paired sales can also be used to support other adjustments, if there are sales of two properties at the same time whose characteristics are highly similar except for one feature. The difference in sale price would be attributable to the different feature (such as soil type or location). Generally, the market needs to be active (a large number of sales) and also deep (a high degree of similarity among properties) to find paired sales. This is certainly not true of agricultural markets and many other markets.

As an aside, in a proper mathematical sense, the appraiser needs one more comparable sale than the number of adjustments being made.5 This fact is often ignored in discussions about paired sales, but the reason is obvious on reflection. If an identical property (to the subject) had just sold at almost the same time as the effective date (hence no time adjustment was required), no adjustment would be warranted to that comparable to reflect the market value of the subject. If another almost identical property had also just sold but had one different feature (say building age), then the different feature would explain the different sale price and, of course, it would support the adjustment for the difference in age. Now we have two sales and one adjustment. For yet another adjustment, another paired sale is required and so on.

In our investigation of easements and farmland, while we have found a number of sales of similar parcels of farmland, with and without such easements, selling for similar amounts per acre (the benchmark for agricultural farmland), none have been truly paired sales. For example, in Finch Township (about 50 kilometres southeast of Ottawa) in early 2010, we investigated a sale of 200 acres of farmland that sold for $1,000,000 or $5,000/acre. We recorded the sale with the following notation:

“This Index represents the sale of vacant farmland (the worked area was tiled at the time of purchase). The cash crop purchaser was adding to his holdings, but did not reside or own farmland in the immediate area. Based on a review of the soil map for Stormont County, the soil is a mixture of Wolford loam and Carp clay loam. The land base was all clear, there were no buildings or bush, and there was one field. The property was subject to a power line easement (there is one steel transmission tower on this property). This sale was discussed with the buyer.”

There were a few sales of farmland in Finch Township in that year that would support the conclusion that the powerline easement had no effect on the market value of the farmland. However, none of these sales was a paired sale. There would always be some factor that could have affected the sale price. Perhaps the ’other’ farmland, although it sold for a similar price per acre without an easement, was a different soil type, or it was tile drained, or the purchaser owned adjacent farmland (and paid a premium for location) and on and on.

The sale

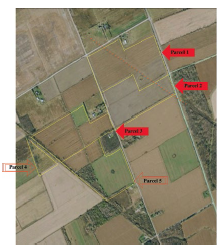

In early 2011, in a rural area in Eastern Ontario, the author investigated a sale of about 259 acres of farmland, including some brush areas, that sold for $1,830,000 (registered 04/29/2011). While there were a total of five parts (5 PINs), the five parcels were in three groups separated by a travelled road and a former rail line. This separation can be seen in the accompanying aerial photo. The sale was registered under two documents for the stated total amount of $1,830,000. While the overall price was about $7,000/acre, it is inappropriate to use that benchmark for each parcel because there was some brush on two of the five properties (parcels 4 and 5), and one of the properties with some brush cover also required tile drainage work (parcel 5). As an aside, since the date of the sale, all of the brush has been removed and all of the tile work has been completed.

Land use controls and highest and best use

All of the land was designated as being in an Agricultural Resource Area under the appropriate official plan, and it was also zoned as agricultural. It had been rented and used as farmland for a number of years, and, although near Ottawa, it was not close to a village or a built up urban area for there to be a speculative interest in the property at this time. Accordingly, in terms of legal constraints and also highest and best use, the five properties were identical. Given the definition of highest and best use,6 it is appropriate at this point to ask if the highest and best use of this property is farmland. The answer is yes, without question.

Services

While services might impact the value of farmland, usually this is not a factor because of the lower order intensity of use. With the exception of parcel 5, the services, such as electrical power, were idential (although not required at the time). Parcel 5, which was not under consideration as part of a paired sale, had no frontage on a road, and it had no electricity.

PHOTOCOPY OF THE AERIAL PHOTO

Parcels 1 and 2 have frontage on their east side, along the same travelled road, and parcel 1 also has frontage on the north side. Parcels 2 and 3 have frontage on a travelled road between them. Parcels 3 and 5 are separated by an abandoned rail line. The approximate location of the power line is shown by the orange dotted line.

Image is courtesy of Google Earth ©.

The vendor, purchaser, and ownership

If one examines the two transfer instruments, the properties appear to have sold from different parties to different purchasers, however, as is sometimes the case with sales, this does not tell the whole story. The negotiations for the sale took place between two individuals, and although registered otherwise, the purchaser and the vendor, for all intents and purposes, were the same.7 This is seldom the case with paired sales, and it usually goes unoticed because the emphasis is on the properties and not on the vendors or on the purchasers. 8

Parcel characteristics

Easements

Our interest is in parcels 1, 2, and 3 because parcels 1 and 2 were crossed by an easement for a 230,000-volt powerline, while parcel 3 was not crossed by a powerline and was not subject to any easement. Parcel 1 had a single steel transmission tower, while parcel 2 was also crossed by the same power line but had no tower.

In all other aspects, parcels 1, 2, and 3 were almost identical as described below.

Soil characteristics

Differences in soil types (these differences can range from clay through loam to sandy soils) can influence soil productivity (both input costs and yields) and, therefore, influence the market value of farmland. Heavy clay soils are more costly to work while lighter sandy soils are easier work but will generally require more fertilizer.

The soil was identical on all of these parcels and was a Castor fine sandy loam. This is a stone-free soil and is considered to be a class 2 soil under the Soil Capability for Agriculture Index.9 Accordingly, parcels 1, 2, and 3 were identical in this important aspect. Parcels 4 and 5 also had this same soil type.

PARCELS 1 to 5 – THE LAND BASE AND SITE IMPROVEMENTS

| Parcel No. | Acres +/- Cult. Uncul | Present use | Topography | Soil type | No. of fields | Tiled acres | Nature of easement | Estimated sale price per acre | |

| 1 | 76 | Crops | Level | Castor fine sandy loam | 1 | 76 | Power line + tower | $7,375 | |

| 2 | 53 | Crops | Level | Castor fine sandy loam | 2 | 53 | Power line | $7,375 | |

| 3 | 62 | Crops | Level | Castor fine sandy loam | 3 | 62 | None | $7,375 | |

| 4 | 8 | Crops | Level | Castor fine sandy loam | – | – | None | $5,275* | |

| 5 | 53 | 7 | Crops | Level | Castor fine sandy loam | 3 | See note below | None | $6,475* |

| Brush | $5,275* | ||||||||

| Total acres | 244 + 15 = 259 Total sale price (rounded) | $1,830,000 |

Note: The colour coded cells represent differences among the parcels (namely the two areas with easements).

*The adjustment for the non-tiled portion (the 53 acres of parcel 5 that needed to be retiled) is based on the current cost to tile of about $900/acre. The adustment to clear the brush and then tile drain the 15 acres (parcels 4 and 5) is based on an estimated cost of about $2,100/acre ($1,200/acre to clear and clean the brush and about $900/acre to then tile the land). These adjustments for the cost to tile and clear brush reflect about $79,000. Prior to the purchase, the buyer estimated the cost to be about $70,000.

This price per acre allocation differs from the total allocation as recorded in the registry office since the recorded allocation was made for ‘other’ purposes and does not reflect the true nature of the land base.

Site improvements

Tile drainage allows earlier planting, and it also results in warmer soil. As with all soil types, the soil type found on these parcels (Castor very fine sandy loam) needs tile drainage for best crop production. All of parcels 1, 2, and 3 were tile drained with systematic tile at 40’ spacing, making them identical in this important aspect. Parcel 4 was covered with brush and parcel 5 had some brush cover, and while it had some random tile drainage, it needed to be retiled.

Topography

While farmland is often level, some farmland is hilly. While this difference could be reflected in the market value, more often than not, it is reflected in the soil type (hilly areas usually reflect a soil with a stone component that farmers wish to avoid). Parcels 1, 2, and 3 were identical in terms of topography and were level parcels. Parcels 4 and 5 were also level.

Parcel size

Differences in parcel size can add to or detract from the marketability of farmland, and it is difficult to definitively predict the effect this might have on market value. Less costly (in an overall sense), small parcels can be added to an expanding farm operation in the immediate area, but they lack appeal to an expanding operation located some distance away. A larger parcel, although more costly to purchase because of its size, would appeal to a more distant farm operation in need of more farmland because the economies of its larger size might offset some of the extra travel costs.

Parcels 1, 2, and 3, although not identical, were quite similar in size (76 acres, 53 acres, and 62 acres). Since farmland sells on a per acre basis, there is no known market data that would suggest that these different sizes would warrant different prices on a per acre basis.

Parcel shape

Most farms in Southern Ontario were laid out in rectangular configurations, and, as a result, fields generally follow that same general pattern being either square or rectangular. Exceptions might occur because of natural features, such as streams, ponds, or forced roads. In one instance, for example, I encountered a sitution where an irregular parcel sold for about 10% less because a drainage ditch crossed the middle of a property and created two triangular fields.

Parcels 1, 2, and 3, however, were remarkably similar in shape.

Number of fields

In light of the ever increasing size of field machinery, cash crop farmers like large fields, as there is less time wasted in turning.

Although not identical in terms of the number of fields (and hence field size), the field size was still quite similar on these parcels. Parcel 1 had one field, parcel 2 had two fields and parcel 3 had three fields at the time of sale. Indeed, with very minimal work, parcel 2 could also be made into one field, and parcel 3 could be made into two fields by removing two fencelines.

Location

Often farmers will pay a premium for farmland because of a close location to their home operation. In one recent instance, a farm operation near Winchester, ON paid about 40% above the market for some additional farmland that was already surrounded on three sides by its existing farmland base.

While no two properties can have an identical location (each property is unique in space), parcels 1, 2, and 3 are also almost identical in terms of their location. Parcels 1 and 2 are adjacent to one another, and parcel 3 is across a road from parcels 1 and 2. The purchaser was not adjacent to any of these parcels and was, in fact, located about 10 kilometres away so that the location of one parcel relative to the others had no bearing on the purchase price.

Road frontage

The amount of road frontage is not significant in terms of pricing farmland, as long as there is reasonable access for field machinery. Even seasonal roads (on a non-maintained road allowance) can be acceptable for access, and, in fact, quiet rural roads are preferred to busy roads. Parcels 1, 2, and 3 had some frontage on a travelled (rural) road and would be considered as being identical in this regard.

The nearly ‘perfect’ paired sale

Given this demonstrated high degree of similarity among the three properties (parcels 1, 2, and 3), it seems reasonable to consider them as paired sales. For all intents and purposes, the three parcels are nearly identical in terms of soil type, tile drainage, topography, field shape, field size, and location. Certainly, they are identical in terms of the attributes that impact on market value, and they all sold for the same price per acre.

They do differ in that two are subject to a power line easement (parcels 1 and 2) and one was not (parcel 3), however, they showed no difference in sale price.

Conclusions

These sales support the conclusion that farmland, subject to this type of easement, does not suffer a change in market value. Once the easement is in place, it seems to be minimized. Based on this sales analysis, the inconvenience of having to work around a tower, such as the one on parcel 1, does not appear to influence the market value of the surrounding farmland.

Just as one sale does not make a market, one ‘perfect’ paired sale is not conclusive for all such easments. But in this instance, it supports the conclusion that no adjustment for such easements would be warranted in appraising farmland until we have other market evidence to the contrary.

Of course, within a farming area that is subject to some urban influence, this conclusion might be different if there was a potential for a change in land use to a higher order, and an easement of this nature was hindering such a change.

Endnotes:

1. See Principles of Right of Way Acquisition, The American Right of Way Association, 1972, pp. 27-28 (a right-of-way can be over a whole property and not just a portion)

2. J. D. Enns, AACI, Easements and Agricultural Land Values, The Canadian Appraiser, Fall 2000, pp. 22-25

3 See Appraisal Standard Rule 6.2.9 CUSPAP 2011 Edition, and Appraisal Standard – Comments 7.10, Characteristics of the Property, 7.10.1v “any known or apparent title restrictions, easements.”

4 See Appraisal Institute of Canada, Use of Comparables Bulletin CP – 17, March 1996, p. 3.

5 R. H. Zerbst, A Caution on the Adjustment of Comparable Sales, The Real Estate Appraiser, November, December 1977.

6. A property’s present use will more likely represent highest and best use in a stable market than in a transitional market. The highest and best use has also been defined as ‘the most probable use..

7. Two of the parcels sold from an individual (A) to a couple (B), while three of the parcels sold from a couple (that included individual A) to a limited company (C). The two purchasers (B) of parcel 1 and 5, however, also owned the limited company (C – the other purchaser) that purchased parcels 2, 3, and 4. As indicated, the negotiations for the sale took place between two individuals so that the purchaser for all five parcels was really the same and the vendor for all five parcels was also the same.

8. For some paired sales, the purchaser can become the vendor on a resale, but usually they are different parties with perhaps different motivations giving rise to some doubt about the validity of this tool.

9. See Soil Capability For Agriculture, Canada Land Inventory, Ottawa 31 G, Department of the Environment, 1967. The index ranges from 1 to 7 where Class 1 soil has no significant limitations in terms of crop use to Class 7 soil that has no capability for arable culture or permanent pasture.

About the author

David Enns, B.Sc. Agr., M. B. A., AACI, is founder and now a senior appraiser at Enns, MacEachern, Pace, Maloney & Associates Inc., which is a full-service real estate appraisal firm servicing Eastern Ontario. He can be reached at www.empm.ca.

—30—