Protecting yourself against valuation fraud

Canadian Property Valuation Magazine

Search the Library Online

By Nathalie Roy-Patenaude, AACI, P. App., Director-Counsellor, Professional Practice

Valuation fraud is misrepresentation of an appraisal report made by a party involved in a mortgage who has a vested interest in the lending decision involving the real estate. Fraud victims in such schemes can be buyers, sellers, or borrowers, but also appraisers. The past two years has seen an increase in valuation fraud, whereby AIC members’ reports have been altered because an intended user or someone with a ‘vested interested’ in the process did not like the final value conclusion. Cases have involved single individuals (e.g., the owner who was the appraiser’s client, a borrower who obtained a copy of the report from their lender or broker and decided to shop around for a mortgage, the lender or broker client), as well as multiple parties within a network. In almost every case reported by members to AIC’s Director, Professional Practice, the uncovering of the altered reports occurred when a diligent intended user read and was trying to understand the report and when things did not add up, they contacted the appraiser who was the author of the report.

Intended user due diligence and their reading and understanding of the appraisal report is critical to ensuring they fully understand not only the characteristics of the property, but also how all the elements of a report come together. Whether it is a narrative or a form report, simply reading the value on the certification page without understanding its content is not due diligence.

Examples of fraudulent behaviour

Here are examples of good lender (institutional, broker or private) or intended user (private lender, lawyer, private individual) due diligence that resulted in the uncovering of fraudulent activity.

- An appraisal is done for a homeowner who brings a copy to his lender. The lender contacts the appraiser to obtain a reliance letter. The appraiser issues a reliance letter in the amount of $635,000, his final value estimate. The lender calls him saying there is a typographical error in his letter because the appraisal report shows a value of $675,000. The bank declines the loan and advises the applicant. The appraiser unsuccessfully tries to contact his client to assess why the value was altered and reports the matter to the local authorities.

- A broker/potential-intended user contacts the appraiser to discuss the appraisal report because he cannot understand how the property in the subject area could be worth $550,000. The appraiser’s original report shows a value of $235,000. The appraiser’s client, the homeowner, altered the report and provided a copy to their broker. The appraiser contacts his client, who became threatening, and reports her to the local authorities.

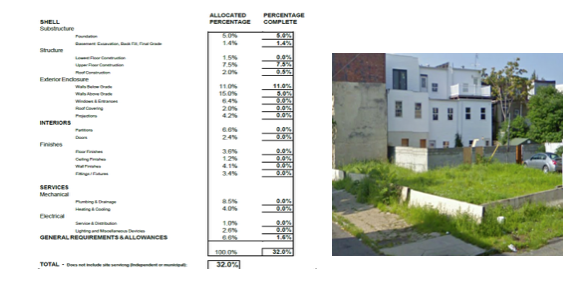

Appraisal fraud can involve a legitimate appraisal report that has been altered. Below is an example of a progress inspection report altered by a builder, prior to sending it to their lender. In this case, the builder was not the client for this assignment, but instead used a previous progress report prepared by an appraiser and altered it. The lender questioned the percentage complete and sent an employee to inspect the site. They discovered that construction had not started. In this case, both the appraiser and the lender reported the builder, who was a long-time client of both, to the local authorities.

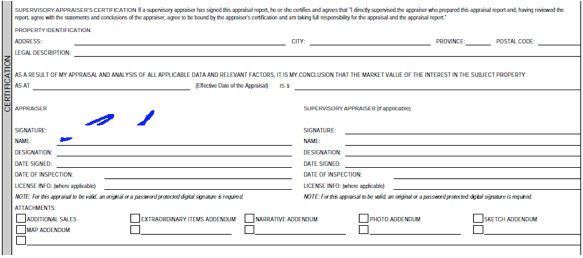

In the example below, the lender contacts the appraiser regarding his signature that appeared to be tampered with. Upon review, the appraiser comments that the whole certification had been “whited-out,” but more importantly, that the value had been altered and increased from $1,025,000 to $1,225,000.

New trends

With the changes in the mortgage underwriting rules two years ago by the Office of the Superintendent of Financial Institutions (OSFI), it has become increasingly difficult for more leveraged borrowers to access high ratio financing through mortgage insurers. This has resulted in a shift of the business from insured financing to increased second, and at times, third mortgage financing. With that comes the requirement for professional onsite appraisals, as good lending due diligence, to help mitigate against any collateral and/or borrower risk. Often, brokers do not know who the lender/intended user will be and “they are shopping the deal” – but, while they shop, they need an appraisal. Under the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP 2014), the intended user must be identified by name; ‘to be determined,’ ‘to be confirmed,’ and ‘John Doe and his lenders’ are not acceptable forms of intended user. Members are directed to Appraisal Standard Rule 6.2.1 and its associated Comments and Practice Notes for guidance and recommended best practices.

Addressing your concerns

Fraud is a criminal activity and should not be taken lightly. The altering of an appraisal report for the benefit of someone else’s financing needs brings huge risk to the intended user who is relying on your report to make an important decision. To mitigate against personal, professional and corporate reputational risk arising out of valuation fraud, members can contact Nathalie Roy-Patenaude, AACI, P. App., AIC’s Director-Counsellor, Professional Practice at or (toll free) at 1-866-726-5996 to discuss and seek guidance.

Fraud prevention tips

- Know your client.

- Know your market – heated markets are hubs for fraud.

- Exercise due diligence in your research — property flips, sales/listing history and exposure time can tell a story.

- Issue letters of engagement with every assignment but particularly with unfamiliar clients.

- Password-protect your reports and only give the password to your client.

- Decline if it doesn’t feel right – providing a reliance letter to a new intended user is not a mandatory requirement; you have the right to decline – it is an extension of risk.

Additional information on valuation fraud prevention, red flags and warning signs

Members are directed to an article on Mortgage Fraud by Nathalie Roy-Patenaude in Canadian Property Valuation, Book 1, 2013, page 12 (https://www.aicanada.ca/article/mortgage-fraud-red-flags-and-warning-signs-for-valuation-experts/), and, if you have not done so already, be sure to attend a Professional Practice Seminar by December 31, 2015, in webinar (https://www.aicanada.ca/continuing-professional-development/professional-practice-seminar-offerings/)or classroom format (check your provincial website for details) where the topic is discussed in greater detail.