Real estate damages: the appraisal of properties impacted by detrimental conditions

Canadian Property Valuation Magazine

Search the Library Online

Real estate damages: the appraisal of properties impacted by detrimental conditions

By Randall Bell, PhD, MAI, founder of Landmark Research Group, who specializes in damage economics and valuation, including environmental, geotechnical, construction defects, natural disasters and eminent domain issues; and Michael Tachovsky is a licensed Certified General Appraiser and Real Estate Broker who is currently a Ph.D. student at Fielding University.

When valuation professionals are asked to analyze properties impacted by detrimental conditions, it can be a daunting task. These assignments are often referred to in a variety of ways, including ‘diminution in value’ cases, ‘impaired’ analyses, or ‘real estate damage’ assignments. While these cases can be complex, there is an established set of methodologies that facilitates a competent study.

The Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) defines a detrimental condition as, “an issue or condition that may cause a diminution in value including: physical (e.g., deficient soil bearing capacity or construction deficiency), external (e.g., proximity to a railway or under an airport flight path), environmental (e.g., soil or groundwater contamination), natural (e.g., flooding or earthquake zone), and/or sociological (e.g., crime scenes).”[1]

The definition set forth in CUSPAP provides some examples of the main categories of detrimental conditions, which break down into hundreds of potential detrimental conditions that can be organized into the 10 basic categories, defined by the Bell Chart:[2]

The Bell Chart

| DC Class | Name | Description |

| I | General Conditions | Baseline description and general market issues – Real estate, franchise, business, FF&E, goodwill, personal property, products, services, etc. |

| II | Transactional Conditions | Unique sales or transfer issues – Motivation, option, assemblage, distress, financing, bankruptcy, foreclosure, etc. |

| III | Distress and Sociological Conditions | Human loss and tragedy issues – Crime, war, terrorism, accident, car crash, air disaster, train derailment, shipwreck, death, disability, illness, injury, etc. |

| IV | Legal Conditions | Legal issues – Eminent domain, contract, tort, insurance claim, title, lot line, CC&R, lien, bond, lease, historic, moratorium, zoning, easement, etc. |

| V | External Conditions | Neighborhood issues – Nuisance, proximity, noise, odor, hazard, power lines, airport, privacy, view, etc. |

| VI | Building and Manufacturing Conditions | Construction, equipment, and mechanical issues Defects, engineering, repairs required, design, code, architecture, infestation, regulations, permits, etc. |

| VII | Site and Infrastructure Conditions | Soils, geotechnical, and right-of-way issues – Drainage, grading, fill, cracking, subsidence, slides, roads, corrosive soils, compaction, groundwater, utilities, etc. |

| VIII | Environmental and Biomedical Conditions | Contamination, health, and toxicity issues – Spills, hazmat, asbestos (1979), lead paint (1978), mold, radioactive, metals, solvents, biological, hydrocarbons, plague, epidemic, etc. |

| IX | Conservation Conditions | Cultural and natural resource issues – Habitat, endangered species, natural and cultural resources, archaeological, shoreland, wetland, overpopulation, etc. |

| X | Natural and Climate Conditions | Natural disaster and weather issues – Flood, hurricane, typhoon, wildfire, seismic, volcano, tornado, global warming, tsunami, famine, drought, storms, etc. |

The Bell Chart is a valuable tool that valuation professionals can use to provide a meaningful assessment of a detrimental condition. For example, the Bell Chart can help identify similarly categorized properties for use in paired sales or as case studies.

Detrimental condition stages

Detrimental conditions often involve a timeline, which is directly tied to the date of value. There are three stages to the lifecycle of a detrimental condition. These are, (1) the assessment (before repair), (2) repair (during repair), and (3) ongoing (after repair). While not every stage is necessarily relevant to every detrimental condition assignment, they should all be considered.

The assessment stage occurs when a property is being assessed, usually by engineers, contractors, or other qualified experts. Often during this stage, the extent of risks associated with a detrimental condition are still being characterized. The repair stage occurs if repairs are required, and takes place after the assessment stage. The ongoing stage involves post-repair issues and may reflect continuing or subsequent problems associated with a detrimental condition.

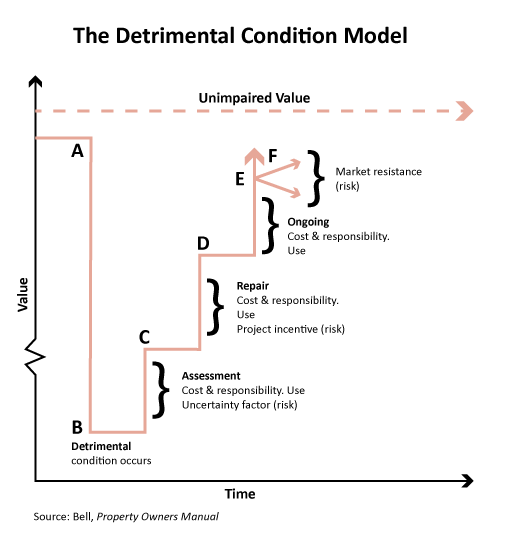

Detrimental Condition Model (DC Model)

The Detrimental Condition Model (DC Model) can be used to illustrate fundamental valuation issues, though a wide variety of additional illustrations can be derived from it. In other words, the DC Model reflects one possible value pattern, but any number of subset graphs could be applicable depending on the data.

Typically, the first step in any of these studies is to value the property in its undamaged or ‘unimpaired’ state. This may require a hypothetical assumption. In then determining the value ‘as-is,’ the DC Model illustrates the progression of stages over time. With the various stages of a detrimental condition, it is important for valuation professionals to be aware of the condition of the subject property as of the effective date of value. It may be appropriate to utilize extraordinary assumptions or hypothetical conditions when setting forth “as-if repaired” values.

Cost-Use-Risk Valuation Methodology

Along with the three stages of detrimental conditions, there are three sub-issues to consider within each stage. These are, (1) cost, (2) use, and (3) risk.

Cost effects primarily represent deductions for costs to repair or remediate a detrimental condition. These costs are usually estimated by someone other than the appraiser,[3] and should include consideration of any increased operating costs due to property remediation. The valuation professionals should also be aware that the market might not recognize all estimated costs as having an effect on value.[4]

Use effects reflect impacts on the utility of the site as a result of the detrimental condition. If the detrimental condition or its remediation rendered a portion of the site unusable, or limited the future highest and best use of the property, then there could be a use impact. The key question is whether or not the normal use and enjoyment of the property were impaired. In considering this, it can be useful to analyze the bundle of rights, including but not limited to the right to sell, the right to lease, the right to occupy, the right to mortgage, and the right to bequest (give away).[5] Some relevant use analyses include: loss of use, project delay, ground lease analysis, temporary construction easements, a study of income and yield capitalization rates, and so forth.

Risk effects, which are sometimes called by their nickname of ‘stigma’ often represent the most challenging part of the appraisal assignment. These effects are derived from the market’s perception of increased risk and uncertainty. In other words, the question is whether or not the detrimental condition, even after any repairs, has incurred any market resistance due to the disclosure of the condition? The analysis of the effects of increased risk and uncertainty on property value must be based on market data, rather than unsupported opinion or judgment.

When considering the three stages of detrimental conditions, along with the costs, use and risks, valuation professionals can consider numerous techniques when determining the impact, if any, on a property’s value. Some of the techniques may include paired sales, sale/resale, case studies, multiple regression, simple regression, market surveys, literature review, foreclosure rates, sales volume, days on market, listing discounts, mortgage rate adjustments, insurance adjustments, project delay, loss of use, temporary construction easement analysis, a study of income and yield capitalization rates, and other methods.

With a number of available techniques to consider, a valuation professional needs to know what it is they are measuring. Traditionally, in the valuation of a property where no detrimental condition exists, there are three approaches to value: the cost approach, the income approach, and the direct comparison approach. Likewise, there are three considerations to make in the valuation of an impaired property: cost effects, use effects, and risk effects. While the three traditional approaches to value are different than the three considerations of an impaired analysis, they do have a clear correlation.

REAL ESTATE DAMAGE ECONOMICS

| Unimpaired Traditional Approaches | Impaired Real Estate Damage Approaches |

| Cost Approach | Cost Effects |

| Income Approach | Use Effects |

| Sales Comparison Approach | Risk Effects |

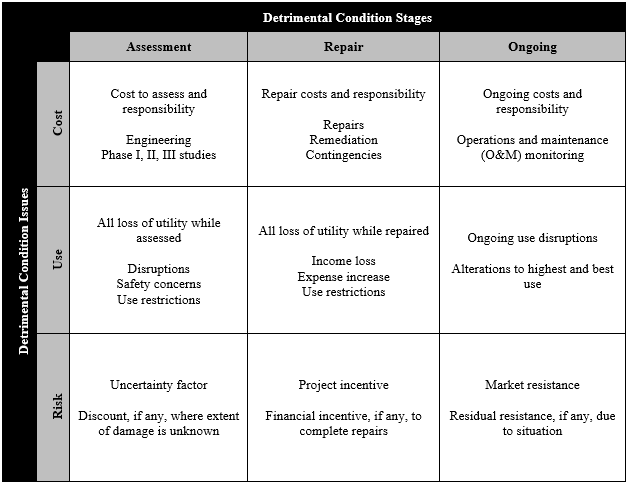

Detrimental Condition Matrix

A Detrimental Condition Matrix (DC Matrix) can be used to outline the assessment-repair-ongoing stages in relationship with cost-use-risk issues. For valuation professionals, the DC Matrix is a framework that encompasses every potential stage of a detrimental condition, along with any impacts related to the costs, loss of use or utility, or the risks. While being comprehensive, the DC Matrix is also a simple tool to explain the process to the client or a jury.

The DC Matrix serves as a practical tool for organizing the numerous issues that accompany a detrimental condition assignment. While not every quadrant is necessarily applicable, by taking one quadrant at a time, a clearer analysis comes into focus. Each quadrant should be considered, however, they may not be relevant for a specific assignment.

Conclusion

While valuation professionals are observers of real estate and recognizing, detecting or measuring detrimental conditions is often beyond the scope of their expertise,[6] measuring the effects of a detrimental condition on value should not be. The Detrimental Condition Model, the cost-use-risk effects valuation methodology, and the Detrimental Condition Matrix provide valuation professionals with a framework for addressing such assignments.

End notes

[1] Appraisal Institute of Canada, Canadian Uniform Standards of Professional Appraisal Practice, Effective January 1, 2020, Definitions 3.19.

2 Randall Bell, Real Estate Damages, 3rd Edition (Chicago, IL: Appraisal Institute, 2016): 29.

3 Appraisal Institute of Canada, exposure draft of Practice Notes dated March 7, 2019, paragraph 4.5.1.

4 Thalheimer and Parker, “Managing Contamination: for Productive Use, Development and Diversification of Real Property,” Canadian Property Valuation 59, no. 3 (2015).

5 Appraisal Institute of Canada, The Appraisal of Real Estate, 3rd Canadian Edition (British Columbia: UBC Real Estate Division, 2010): 6.2.

6 Appraisal Institute of Canada, exposure draft of Practice Notes dated March 7, 2019, paragraph 4.6.1.