Stopping the cycle of ‘unsecured’ adjustments in the DCA

Canadian Property Valuation Magazine

Search the Library Online

No appraisal organization invented the three approaches to value. They were all created by economists and academics from about 1850 to 1920. However, the credit for formatting the direct comparison approach (DCA), for example, should be given to either the Appraisal Institute of Canada (AIC) or the Appraisal Institute (AI). The author could not find any historical evidence either way. Although there was a formatted structure to complete the DCA, the elusiveness of both ‘what to adjust for’ and the actual ‘adjustments’ process is still problematic even today.

The textbooks in the 1960s were centred on the paired sales method and used either a percentage or a dollar adjustment to signal an adjustment in the DCA. The textbooks all gave good examples of adjustments (hypothetical of course) that demonstrated the usefulness of using paired sales. At that time, there was no other method available to valuers.

Considerable criticism emerged about the percentage or dollar adjustment figures. By the 1970s and 1980s, the DCA adjustment process changed. Instead of recognizing that adjustments could be better supported by the use of mathematics, symbols and/or words replaced the percentage and dollar adjustments. Unfortunately, this strategy further reinforced the ‘unsecured’ adjustment process.

The learning procedure for making adjustments was a dark hallway for the budding real estate practitioners to venture down. The appraisal books said one thing, but the bitter truth of reality (lack of sales or sales not comparable, but had to be used anyway) further exacerbated the problem. The default solution was to turn to one’s mentor. The candidate soon learned that there was no real support for adjustments, but an intuitive sense of the process. It was based upon ‘reasonableness.’ This ‘reasonableness’ position was further supported by the many years of being a real estate practitioner. The author is still befuddled that the accepted method of adjustment is ‘reasonableness’ without any proof if an adjustment was even warranted or if the selected variables were explaining the variance between the selling prices of the selected comparables. There is nothing wrong with ‘reasonableness’ and ‘intuition’ as a base for completing a DCA. However, without a DCA that can test for the validity of our intuitive senses and reasonableness, then what is the point of making any decisions regarding comparable sales?

Do not look for answers regarding the DCA in the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP). It does not recommend or require the use of the DCA, but it does indicate that a real estate practitioner must avoid an unsupported assumption or premise. The greyness behind these assumptions is the ‘reasonable appraiser’ test. This means that reasoning should be part of the logical review, analysis, and interpretation of the data in a manner that would support the conclusion. It is most important not to mislead the reader and be at a level consistent with the reasonable appraiser standard.

It says in one breath that a valuer must avoid unsupported assumptions or premises. Note that it never says ‘adjustments.’ Is that what an unsupported assumption is? Either an adjustment is supported, or it is not. If we find 10 ‘reasonable appraisers’ using ‘unsecured’ adjustments in the DCA, does that make it all right? Perhaps the more preferred role of a ‘reasonable appraiser’ is this:

“I selected comparable sales deemed appropriate and made decisions about the sales based upon my experiences and intuition. I then ‘tested’ my DCA by applying some simple mathematics that indicate the results are within acceptable market tolerances.”

Examples of unsecured adjustments

Adjustment Method A: This appraiser voided any attempt to make adjustments or rationalize the difference between the sales. The sales all appeared on several pages in the report. On the next page, the value of the subject property fell out onto the page. Where it came from nobody knows.

Adjustment Method B: The selling price per square foot of building for Index #1 was $46.50 and $52.17 for Index #2, as an example.

The following adjustments were made:

| INDEX NUMBER | 1 | 2 |

| Quantitative Adjusted Sale Price per Square Foot of building | $46.50 | $52.17 |

| ADJUSTMENTS | ||

| Location | + | = |

| Building Size | – | + |

| Building Age | + | – |

| Lot Size | – | – |

| Basement Finishing | + | + |

| Parking | – | – |

| Final Adjusted Selling Price Per Square Foot of Building | $43.75 | $47.35 |

How does the $46.50 change into $43.75 and the $52.17 to $47.35 by using a -, +, =, +?

Adjusting Method C: is the same as Method B. The adjustments are words such as similar, same, better, poorer, etc. Somehow these words are translated into an actual adjustment figure dollar amount. Not sure mathematically how that can happen.

Adjustment Method D: This method uses either +- or words. However, the adjusted selling prices of the comparables are expressed as greater than $50.00 to lower than $100.00. Nobody knows how much greater or lower.

Adjustment Method E: The selling price of the comparables is $50 to $100 per square foot of the building. The adjusted selling price of the sales is $51 to $99. Therefore, what, if any, adjustments were made?

Adjustment Method F: The selling prices of the comparables were averaged and this number was applied to the subject property. There is no point in using the average of any number unless you know the spread around the Mean. If the spread or standard deviation is below 5%, then there is nothing wrong with this method. However, the number and quality of the sales become an issue.

When we examine the above, we would say: “How illogical the ‘unsecured’ adjustment process seems.” It is easy to look back and be critical, but the bottom line is that dealing with small databases can be very frustrating when not incorporating some basic mathematical tools to help the real estate practitioner ‘explain’ and ‘reduce’ the variations in the selling prices of the comparables. However, before the author turned to data analysis, many of the above methods were incorporated into his reports. That was all the tools and knowledge that the author had. However, there was always the nagging doubt that, if the report was questioned, could the adjustments be explained? The author believes that these ‘unsecured’ adjustment methodologies even today are clear signals that real estate practitioners still have problems dealing with small data basis.

A very important question when challenging ‘unsecured’ adjustment in the DCA is: “Does this mean all these appraisals are wrong?” The answer to that question is somewhat irrelevant. What we can say is that the above illustrations using ‘unsecured’ adjustments put the valuer at a higher risk if the report is placed under heavy scrutiny. Why put yourself in the situation? The preferred question is this:

“Is there better technology out there that can lessen the ‘unsecured adjustment’ position and give the real estate practitioners greater confidence through ‘testing’ of their intuitive sense of real estate markets?

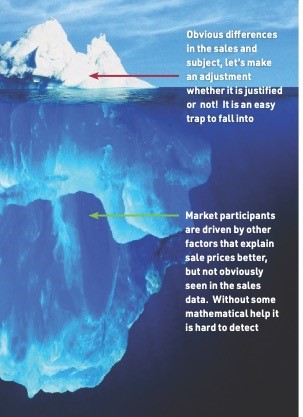

The problems of small databases are shown in the illustration.

Many ‘real estate practitioners’ feel that dealing in real estate is a very specialized field (which it is) and there are no tools available to help sort out the confusion and the many ‘curveballs’ that the data is throwing out. Real estate sales data is not any more complex than any other data found in the world. It is all DATA that can be analyzed to reveal the patterns of behaviour of the transaction or event. A good starting point for exploring one’s data is STATS 101: Math Literacy for Real Estate Professionals. CPD 140 from SAUDER School of Business Real Estate Division.

Why do we need to change our thinking about dealing with small under 10 sales data basis to a more flexible format that removes much of the complexities of reconciling sales data? Here are some good reasons.

#1. Over the last 10 years, we are seeing more MBAs coming into the real estate marketplace either as lenders or working for real estate investment companies. Their knowledge of data science is very good and much of what they do is centred on statistics integrated into spreadsheets. Logic should dictate that the appraisal industry needs to step up its game when it comes to more advanced methods of dealing with small comparable databases, particularly when the issue of ‘unsecured’ adjustments can be easily resolved.

#2. Data science is nothing more than using mathematics to reveal what the data is trying to tell us. Here are some excerpts from the internet:

“By 2019, postings for data scientists on Indeed had risen by 256%, and the U.S. Bureau of Labor Statistics predicts data science will see more growth than almost any other field between now and 2029. Jul 15, 2022”

The book Real Estate Analysis in the Information Age, by Kimberly Winson-Geiderman, Andy Krause, Clifford A. Lipscomb, and Nicholas Evangelopoulos sends a clear message.

“The real estate industry has a reputation as a late adopter of new technology.” This conservatism is driven in no small part by the fact that real estate is conducted one deal at a time…..”

“The valuation arm of the profession was at the forefront of this progress, with tax assessors and real estate appraisers some of the first to use spreadsheets and statistical methods to improve property valuations, paving the way for today’s AVM. Real estate firms came under increasing pressure to adapt or face probable failure. The reverberations of this transformation are still being felt as the search for information and competitive advantage in ‘big data’ and the associated ‘big data analytics’ are now the latest trends in the industry.”

#3. Increasing the professionalism of the report by incorporating statistics when using small databases.

#4. Learning new ways to problem-solve tough real estate valuations by coupling higher levels of mathematics and incorporating them with one’s intuition and experiences. This means a higher skill level that will lead to higher fees.

#5. Much greater awareness of market trends through data analysis. Marcus Aurelius, Meditations, iv: 45 said it best about knowledge and putting that knowledge to work.

“In the series of things, those which follow are always aptly fitted to those which have gone before; for this series is not like a mere enumeration of disjointed things, which has only a necessary sequence, but it is a rational connection: and as all existing things are arranged together harmoniously, so the things which come into existence exhibit no mere succession, but a certain wonderful relationship.”

#6. The growing awareness of artificial intelligence (AI). Recently on the BBC, a news line reported that AI will replace 300 million jobs. One cannot wonder how AI could impact the real estate appraisal industry. Much of the impact of AI could be softened by using more mathematically based decision-making in the appraisal process.

The best DCA to date is Quality Point (QP) when it comes to the best alternative to dealing with ‘unsecured’ adjustments. It is not new and has been around for 30 to 40 years. Featured articles about it have appeared in both our appraisal magazine and the one in the USA. It is an approved course by the AIC because the author and Charlies Abromatis, P. App., AACI taught it in many areas of Ontario and Eastern Canada. It is noted that, when we did, the classrooms were always full.

QP uses an Excel program as its base.

The biggest advantages are:

- Can qualify time adjustments more easily.

- It has two built-in ‘testing’ features that move the adjustments from ‘unsecured’ to secure.

- Can be used in determining the Highest and Best Use of a property.

- Can be used to determine a GIM.

- Can be used to isolate the value of a single aspect of real estate. Recently, it was used in a lawsuit situation to establish the contributory value of a wind turbine on a property.

- Valuers do all the thinking when using QP. The built-in mathematics just aids the user in making decisions faster. It is not an AVM. It is more like a calculator.

- Works very well in data-starved environments.

- Forces the valuer to be more exacting in both the selection of the sales and the unit of comparison.

- It allows the real estate practitioner to apply their experiences and intuition in an exploratory manner.

- Easy to explain in a courtroom setting.

- It is free.

- Uses an ordinal score of 1-2-3-4-5-6-7, or its repositioning of 1-4-9-16-25-36-49 when it comes to making adjustments(for lack of a better term). Therefore, one does not need to struggle with: paired sales (they do not exist anyway), % and $ adjustments, symbols such as +,-, and 0, and words such as inferior, similar, better, indexes, graphs, mls time series data, and costing out basement improvements or sheds, for example.

QP is not perfect and after using it for 20 years in some of the most data-starved environments or within irrational real estate markets, it has been more of a saviour than a hindrance. George Box, a very famous statistician, said it best:

“All models are wrong, but some are useful.”

QP has been one of the useful ones for sure.

Summary

The solving of adjustments was completed by academics many decades ago. There are mounds of papers to read that have been published over the last 70 years that have dealt with the problems of adjustments in the DCA. Most valuers are not aware of that, and they should all be encouraged to read articles that deal with data analysis.

It is not too late to adopt new ideas and methodologies into your field of real estate study. The author fears that, if we do not start incorporating higher mathematics in the appraisal process, there are forces at work that will make the changes for our industry and we may not be too happy about it. Besides, any good Mandalorian would say “This is the Way.”