Trends and considerations for appraising agricultural properties

Canadian Property Valuation Magazine

Search the Library Online

By Brandon Wilcox, P. App., AACI, S.W. Irvine & Associates; and Kim Passmore, P. App., AACI, S.W. Irvine & Associates

Appraising farms, like any other asset class, requires a certain level of competence from a Professional Appraiser (P. App.). A high degree of knowledge and professionalism is expected by clients in the agricultural space — and deservedly so. Part of the allure of being an appraiser is meeting the challenges of diverse projects to learn the nuances that determine value in any market. Fortunately, we do not have to walk a mile in someone else’s ‘boots’ to get an idea of what they find valuable about a farm property, although it definitely helps. Despite general agriculture zoning and permitted uses typically being similar, a cash cropper’s land requirements will vary considerably from those of a market garden grower and, even more so, from a horse farm or other livestock operation. Considering highest and best use in more specific detail is paramount to learning the driving forces behind farm values in certain areas.

So, let’s harvest some of real estate’s general principles and apply them to a farming context by examining how wars, disease, weather, and interest rates will keep prices of farmland dynamic for years to come, and how basic valuation adjustments and units of comparison differ by consumer types in agricultural appraisal.

Prime location can have very different meanings based on how a land user intends to apply its features. For example, boarding horses close to an urban centre is convenient, as recreational horse-riding often draws from suburban participants as opposed to a rural crowd. By the same token, standard and thoroughbred racehorses are often located near racetracks. These, again, rely on urban populations. On the other hand, livestock farm values are less inclined to correlate with urban proximity, but instead prioritize geographies with fertile soil. Other more traditional farming areas place a high value on flat grounds for large machinery, uniformly shaped parcels, and proximity to grain elevators or livestock producers, as opposed to urban areas.

The Direct Comparison Approach (DCA) to value is often the primary method of valuation for the average farm. When considering more improved farms, support from the Cost Approach (CA) can be helpful to supply reassurance that the values shown in the Direct Comparison Approach are reliable. There are very few instances where the Income Approach has relevance when valuing farms. This is mostly to do with the fact that most farms and accompanying structures are typically owner occupied and the ones that are not often have unique rental circumstances and limited market data to deliver reliable lease or capitalization rates.

In addition to selecting the best comparable sales, selecting the most relevant unit of comparison is a crucial exercise when using the Direct Comparison Approach to value farms and farmland. At a high level, cash croppers are primarily concerned with workable land, so using a rate per workable acre is often the most relevant approach. When the subject has less than 75% workable acres on their entire farm, there are circumstances where overall rate per acre might be more applicable than using a rate per workable acre.

When farms are bought for more recreational or rural residential purposes, comparing the total sale price and making adjustments thereon is more practical than trying to apply a rate per acre, because these buyers are not necessarily using the number of acres to make their buying decision.

Overall, selecting sales most comparable to the subject is always the key to substantiating value. Using sales of properties which would appeal to similar market participants provides the best information to then make sound conclusions and arrive at a final estimate of value.

The COVID-19 pandemic has been talked about enough over the past few years, so we will keep the point short and sweet here as to some of the pandemic-related trends we witnessed from 2020 through 2023. The metropolis exodus is more or less over and many people are returning to their regular commuter lifestyles. The appeal of owning rural property and hobby farms has subsided, as maintenance and upkeep of these property types takes a great deal of money and, more importantly, time. During the pandemic, the 10- to 50-acre farms just outside of urban centres saw some of the biggest jumps in value, as borrowing costs were low and people flocked to have more space. Fast forward to 2023 and Canadians are essentially back to work and areas of the country with bad cell reception or poor internet connectivity might not fit the hybrid model that many now follow in their workplaces. The country lifestyle that so many dreamed of during the pandemic does not always facilitate the hybrid work model that so many now follow. In fact, we have noticed that these hobby farms and rural estate properties experienced the largest decline in value as interest rates began to increase.

As the housing market cooled in some urban areas in early 2022, the working farm not only maintained its value, but increased in value. The 2022 FCC Farmland Values Report illustrates this growth, with land value increases of 8.0% to 19.4% making the average national increase in farmland value 12.8% for the period between 2021 and 2022. (Note: Due to lack of data, these figures exclude Newfoundland and Labrador, Northwest Territories, Nunavut, and Yukon.) This increase in value is the highest since the farmland value boom of 2012/2013.

Like all things in our economy, value is driven by supply and demand. Events such as Russia invading Ukraine, a major world corn and soybean producer, created fears of supply shortages. In turn, commodity prices shot up. When prices of animal food like corn and soybeans rise, so do prices of those animals, as well their meat and byproducts like eggs, milk, and cheese.

In addition to supply and demand, inflation has seemingly played a large role as well. For a period, the traditional bank barn, older livestock barns, and even farm sheds were nearing the end of their useful lives. However, when the costs to replace or rebuild some of these structures skyrocketed, farmers began to use repairs, additions, and alterations to squeeze some extra utility out of structures that would otherwise be ‘taken out to pasture’. Contributory values placed on some older farmhouses and livestock buildings saw a definitive bump from years past, when some of these structures would have been, for all intents and purposes, written off. In general, some of these trends are starting to return to what would have been seen pre-pandemic, but appraisers have had to be cognizant of these trends over the last few years.

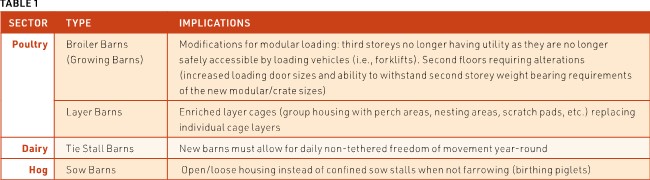

Staying up to date with trends in agricultural building code is also important while valuing livestock buildings. Nearly all sectors have had some guideline changes centered around improving animal welfare. Table 1 indicates a few notable changes.

The S.W. Irvine & Associates internal databases suggest construction cost increases between 54% and 68% across all three of these livestock housing sectors from 2019 to 2022/2023. These cost increases are not directly associated with the previously mentioned animal welfare changes, but rather a combination of supply shortages in both labour and material, primarily lumber and concrete. More recently, interest rate increases and high construction costs have impacted plans for farmers considering building new structures. Instead, they are choosing to modify and modernize their existing building envelopes, or delay construction until costs normalize somewhat.

The importance of Canadian agriculture is increasingly at the forefront of conversations around the national economy. This is due, in large part, to pressure to expand urban areas in order to meet housing demand, increasing concerns around food security, and climate change. Although there is much to be considered in determining the competence of a given appraiser, especially since agriculture is such a diverse sector, chief among these considerations is an appraiser’s ability to keep up to date with changing factors, such as supply, demand, inputs, and regulations. Gaining or increasing competency as a Professional Appraiser (P. App.) takes time and effort, whether it be through research, courses, and/or aligning yourself with a subject matter expert. Besides our Canadian Uniform Standard of Professional Appraisal Practice (CUSPAP) requirements, farmers are the real industry experts and they are owed the courtesy of being knowledgeable, professional, and up to date on the rapidly changing industry that is their business and livelihood.