Valuing hotels in tumultuous times

Canadian Property Valuation Magazine

Search the Library Online

By Cindy Schoenauer, P. App., AACI, Cushman & Wakefield – Vice President, Hospitality and Gaming, Valuation & Advisory

Introduction

2020 will always be remembered for the speed with which COVID-19 arrived and affected our lives and businesses. For the Canadian hospitality market, it was a year that stressed the industry nearly to its breaking point.

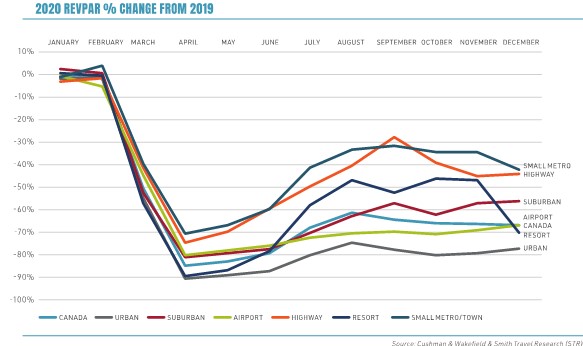

In Cushman & Wakefield’s 2020 Hotel Sector Outlook, we anticipated slowing growth after 10 years of uninterrupted growth and expansion. As Q1 2020 ended, and the COVID-19 pandemic became a reality, hotel markets across the country saw unprecedented declines. The Canadian hotel industry lost 60% of its revenue in 2020, with monthly occupancy rates dropping to as low as 14% nationwide by April of that year.

In April and May 2020, the question quickly became: “How do we value hotels during a rapid decline and recovery period?”

The following chart is from Cushman and Wakefield’s Canadian Lodging Overview, published in January 2021, which outlines the change in Revenue Per Available Room (RevPAR) by month and by location throughout 2020:

The market study

An important component of a hotel appraisal is the market study. Smith Travel Research (STR) data is the most widely used in the global hotel sector for monitoring the performance of hotel trends and growth. During the pandemic, STR was providing the industry with weekly updates for the metrics of occupancy, Average Daily Rate (ADR), and RevPAR.

The Cushman Wakefield team attended weekly STR webinars to understand the latest trends for both the United States and Canada, as certain markets and hotel types were recovering faster than others. We were monitoring airport traffic patterns, public health travel restrictions by province, information from the International Airport Transport Association, Air Canada and WestJet, as well as economic and tourism forecasts. Destination Canada, in partnership with Tourism Economics, was also continuously updating industry participants with weekly webinars and COVID-19 Tourism Outlooks reports. These forecasts outlined the recovery for tourism expenditures and visitation levels by geographic area (Domestic, US, Mexico, International, etc.).

With this market intelligence, we were able to understand that the path forward for recovery would be unique for each hotel based on its type (limited-service, full-service, etc.), scale (economy, luxury, etc.) and location (highway, airport, urban, resort, etc.). We would have to look at each appraisal differently.

Over the course of the pandemic, we prepared detailed monthly topline projections (demand and ADR growth) for the market and subject for the first two years of the projection period. Our market studies estimated that, in 2023-2024, the subject hotel and market would recover from the pandemic in both demand and ADR, which would assist in estimating the year in which hotel values would stabilize.

Valuation method

In 2020, hotel transaction activity decreased to levels not seen since the recession of 2009. There were very few sales of hotels, which is why the Direct Comparison Approach could only provide an indication of value based on pre-pandemic income levels. Over 2021 and 2022, nearly a quarter of total hotel sales were for conversion to alternate use or redevelopment.

Over the course of the pandemic, at a time when most hotels were incurring significant net income losses, the industry received much needed government assistance in the form of government funded subsidies. With no net income to capitalize and derive value from, the most reasonable method to value hotels was the Discounted Cash Flow Method of the Income Approach. Applying a direct capitalization rate on trailing 12 months’ net income or on projected year one income could not reflect a reasonable market value from 2020 through most of 2022. Therefore, the approach taken was to adjust cash flows vs. capitalization rates.

According to the recovery growth projected in our market studies, and with guidance from historic and year-to-date detailed operating statements, pro forma projections were carefully prepared. Adjustments were required for government subsidies, one-time quarantine contracts, skeleton staffing models, vacancies due to labour challenges, and increasing costs of labour.

Impact of inflation and evolving capitalization rates

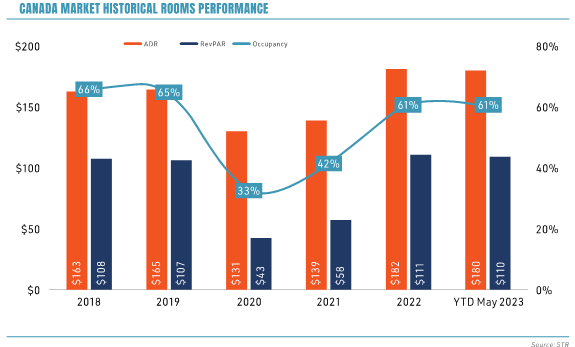

In 2022, most hotel markets in Canada experienced accelerated ADR growth, which resulted in most hotels achieving ADRs well above pre-pandemic levels. The following chart shows the Historical Canadian Hotel Market Performance from 2018 to 2022, plus the period for year-to-date results for May 2023:

Higher demand for domestic leisure largely drove ADR gains in 2021 and 2022, as travel outside of Canada was restricted. The outlook for 2023 and 2024 is for the continued recovery of group and corporate sources of demand, which pay discounted and negotiated fees, and should result in the levelling off of ADR growth. That said, ADR growth was up 17.1% according to YTD May 2023 year-over-year results, which indicates that rates are elevated due to inflationary factors.

Despite the recuperation of room revenues, maintaining higher net income levels has been a challenge for most hotels, as operations face increased costs for labour, goods, and materials. StatsCan reported that the Consumer Price Index rose 6.8% on an average annual basis in 2022, led by food and energy costs. Hotels continue to see rises in the cost of utilities, insurance, and property taxes as well. In addition, salaries and wages have risen with further increases in minimum wages, and because the accommodation and food sector is the lowest paying industry in Canada, hoteliers have had to increase both pay and benefits substantially to compete with other sectors. A healthy 5.4% unemployment rate has also contributed to ongoing labour challenges.

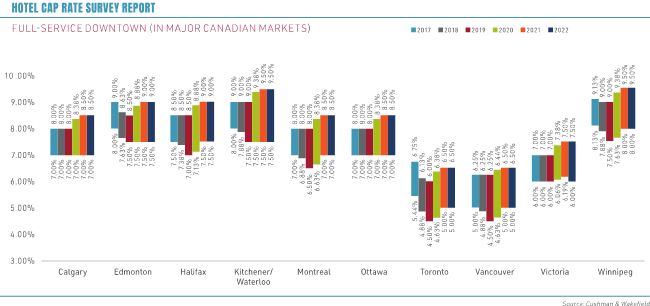

In general, hotel capitalization rates have increased between 50 to 100 basis points since Q2 2020. Hotel capitalization rates are published in Cushman & Wakefield’s quarterly Canadian Cap Rate Report. While the range in rates for hotels has not shifted since early 2022, the survey does indicate increasing upward pressure on capitalization rates across all asset classes driven by economic uncertainty, high inflation, and the rise in interest rates. Historically, changes in interest rates alone did not drive changes in capitalization rates. Capitalization rates are more directly impacted by flow of capital to the sector and investor expectations. For the hospitality sector specifically, capitalization rate increases have been less than expected, given good investor demand and a limited amount of hotels available for acquisition.

The following chart shows the movement of hotel capitalization rates for full-service hotels throughout major markets in Canada from 2017 to 2022.

Into 2023, we continue to value hotels carefully, as we evaluate strong ADR gains, the impact of rising costs, and investor interest in determining the appropriate capitalization rate.

Conclusion

Valuing hotels during rapid decline and recovery conditions requires a finger on the pulse. Ongoing research, analysis, and observation of a multitude of variables is critical in understanding the state of the industry. As hotel specialists, through access to up-to-date research, data, published industry forecasts, and outlooks, we were able to develop a strong

market study component, which would pave the way for reasonable cash flow projections. Using the discounted cash flow method allowed for all these variables to be reflected in value with the application of stabilized market derived capitalization rates. Ongoing correspondence with hotel owners and brokers, and discussion with hotel operators, was also critical in obtaining an understanding of the situation and preparing a recovery trajectory. The market will continue to reclaim demand levels over the next two years, and ADR growth should normalize. This tumultuous period in hotel history has made for a stimulating time for owners, operators, appraisers, and brokers.