You think it is worth HOW much?: Tips for preventing and dealing with client concerns

Canadian Property Valuation Magazine

Search the Library Online

By Alana Jennings-Coutts, P. App, CRA and

Jason Schellenberg, P. App., AACI, PGCV, B.Com. (Hons.)

Being an appraiser has become more challenging in recent years. Many people are more anxious about their financial future due to factors such as an aging population (with corresponding health concerns), rising healthcare costs, concerns about housing affordability, and increasing social and political division. Adding to these concerns, rapid inflation has intensified financial stress, and uncertainties surrounding Artificial Intelligence (AI) and its impact on employment have only compounded these worries.

During the COVID-19 pandemic, many people found that their current living situation no longer met their needs, especially with the shift to remote work. As a result, people sought larger or more functional spaces, often at any cost. Bidding wars became common, with buyers paying significantly over asking prices. Many property owners also leveraged their increased property values for refinancing, leading to heightened expectations of their home’s worth. Unfortunately, appraisers are often viewed as the ‘bad guys’ when delivering the reality that a property’s worth is based on market data, not personal expectations.

In many areas, the housing market reached its peak in early to mid-2022, only to decline as rising interest rates were introduced to combat inflation. As property values dropped, appraisers faced mounting pressure to reconcile market realities with owner expectations. So, what can we do in the face of these challenges?

The importance of relationship capital

When dealing with client concerns and unrealistic value expectations, an appraiser’s most powerful tool is ‘relationship capital’ – the trust and credibility built over time through professional interactions. Building this trust requires prompt communication, reliability, and empathy. If clients feel they have been treated with professionalism and respect throughout the appraisal process, they are more likely to accept the final report, even if it does not meet their expectations.

Initial contact

Gather as much information as possible during the initial interaction with a client or owner. Identify the appraisal’s purpose and authorized use, the authorized user(s), and key details such as the effective date(s) and required timelines for delivery. Take time to explain the appraisal process, especially to those unfamiliar with it, and allow them to ask questions.

A written quote or email confirmation after a phone inquiry helps clarify the scope of work, fee structure, and other key details. While preparing a letter of engagement is always a good idea to ensure all details are clear, at a minimum, having an email or other written document can help to confirm the key facts and ensure mutual understanding of the assignment and work to be performed.

The site visit

Arriving on time and dressing appropriately are essential aspects of professionalism. Upon arrival, introduce yourself, explain the inspection process, and seek permission for photos. Be sure to have a photo consent form. Explain how photos assist in documenting property details, which can increase client cooperation.

Additional best practices for the site visit include:

- Confirm the appointment a day in advance – this can help prevent unnecessary trips if someone forgets or changes their mind.

- Research the property and neighborhood ahead of time so you know what to expect and

where to park. - Greet clients with a smile and friendly demeanor – this can help to build trust.

- Take the time to explain the process, especially for those having their property appraised for the first time.

- Ask open-ended questions to encourage the owner to share relevant information.

- Document all information thoroughly to ensure the property owner feels heard.

- Note and consider any comparable sales mentioned by the owner.

- Provide a timeline for report completion and ask if there’s anything else they want to share.

Preparing the report

In the 1970s, Canadian communication theorist Marshall McLuhan coined the phrase “The medium is the message,” highlighting that how a message is presented affects how it is received. A well-designed, professional-looking report instills confidence in clients. This includes using consistent fonts, appropriate font sizes, and formatting to enhance readability.

Alan Blankenship’s book The Appraisal Writing Handbook emphasizes the importance of clear, logical, and well-structured reports. It notes that the appraisal report is the primary deliverable from the client’s perspective. If an item or factor is not explicitly mentioned, the client may assume it was not considered in the report.

Knowing the final value conclusion before writing the reconciliation helps structure the argument effectively. If the value falls at the high or low end of the range, build the argument accordingly. Qualitative analysis is crucial when numerical adjustments are inappropriate; discussing a factor’s influence may be more effective than assigning an unsupported adjustment.

Consider the following when drafting reports:

- Ensure clarity and logical flow to help guide the reader through the analysis.

- The more significantly an item impacts the value, the more time you should spend explaining how you reconciled it.

- Justify adjustments clearly, explaining why specific sales or market trends were selected.

- Strive to maintain brevity without sacrificing necessary details.

- Proofread reports to eliminate grammatical errors and if possible, have a third party proofread.

- Tailor reports to the knowledge level of the authorized user – the report should look different if it is written to a lender familiar with appraisals than to a layperson seeing an appraisal for the first time.

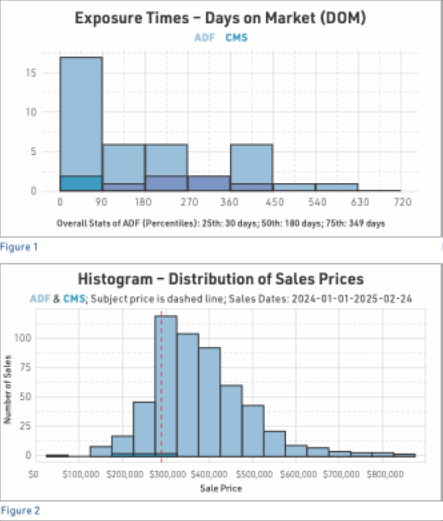

- Use visual aids such as charts and graphs including scatterplots, histograms, and bar charts, to convey appraisal findings effectively. (See example charts: Figures 1 and 2)

Addressing client concerns

Even the most thorough and well-supported appraisal may face objections. This is when relationship capital becomes invaluable. If a concern arises, remain calm and listen actively. Consider the following strategies:

- Verify whether you have permission to discuss the report with the complainant (especially if they are not your direct client).

- Try to show empathy and avoid becoming defensive.

- Summarize the concerns and repeat them to the client to ensure there is mutual understanding.

- Ask, “Is there anything else?” to ensure that all concerns have been presented.

- Choose the appropriate medium for responding. Sometimes, a phone call is more effective than an email, as you can more easily convey the proper tone and empathy.

- It is often best to avoid responding too quickly; allowing time to pass can help defuse emotions. This also gives the impression that the concerns were considered.

- If dealing with a property owner who is not your client, keep your client informed of the process to ensure clarity and transparency.

Summary

Appraisers must recognize that people today are under stress from many sources. Sensitivity to these pressures can help navigate challenging interactions. Building ‘relationship capital’ from the initial contact through the final report enhances trust and smooths potential conflicts. By backing value conclusions with clear, well-organized reports that have a logical flow and supporting visuals, appraisers can improve client understanding and reduce disputes. When concerns arise, listening actively and responding thoughtfully can help defuse tension and maintain professionalism. Strong communication and relationship-building are key to managing client concerns effectively in today’s high-pressure real estate market.