The effect of the reinvention of Canada’s wine industry on land values in Ontario’s Niagara Region

Canadian Property Valuation Magazine

Search the Library Online

By Lisa Campbell, AACI, P.App

Every agricultural property is part of an agricultural industry – e.g., field crops (wheat, corn, soybean, etc.), dairy, tender fruit or horticulture. Each agricultural industry has a history, which has had a direct effect on the market values (past and present) of the properties related to that industry. This article endeavours to study the reinvention of Canada’s wine industry over the 24‐year period of 1989 to 2012, and the effect that this industry’s history has had on the affected agricultural land values in the Niagara Region of Ontario over that time period.

Canada’s wine industry is fairly small in the world theatre, comprising only about 30,000 acres of vineyard area in 2006,1 compared, for instance, with France, which had roughly 2 million acres under vine in 2012. While numerous provinces have significant amounts of vineyard area, Ontario has the most acreage under vine, with approximately 17,000 acres in 2013. Although Canada’s place in the world wine marketplace is quite small, grapes comprise Ontario’s highest farm gate value of any of its fruit industries on an annual basis, comprising 43% of the provincial farm gate value for commercial fruit production in 2012. In 2013, grape sales exceeded $100 million.2 Of the total 2013 production, 97% was reportedly used for the creation of wine products, with the remaining 3% used for juice, jams and other grape products. Ontario has numerous grape‐growing locales, the largest of which is the Niagara Region, with approximately 13,600 acres of vineyards, or somewhat less than half of Canada’s total, according to the Grape Growers of Ontario.

Many fruits are native to North America. Among these is the vitis labrusca, or wild labrusca grape. Historically, these have been used in North America to derive numerous labrusca and hybrid grape cultivars for commercial purposes. Labrusca cultivars today include, but are not limited to, Niagara, Concord and Catawba, and they are quite suitable for the production of juice and jams. However, these cultivars were also used for wines throughout portions of North America, including Canada, many years ago (Catawba is still used in New York State). The fermentation of these grapes results in wines generally described as ‘foxy’ (i.e., having a musty odour and flavour) and considered by many wine enthusiasts to be less desirable than wines without this musty characteristic. Labrusca grapes are found in much of Canada as they are quite winter‐hardy and can withstand Canadian winters and spring frosts with little or no damage to the vine or bud, resulting in more reliable yields on a year‐to‐year basis. As far back as the 19th century, the Canadian wine industry relied heavily upon hybrid grape cultivars, i.e., grapes derived from breeding programs that use labrusca and other species crossed with European vinifera grapes to create cultivars with better wine characteristics, improved hardiness and less ‘foxy’ characteristics. These hybrid cultivars included DeChaunac, Seyval Blanc, Villard Noir and Vidal, to name a few.

Forty years ago, these labrusca and hybrid vines had low risk for production, resulting in reliable profit margins to the farmer. When product prices were high enough, the greater reliability in profit margins from these varieties resulted in a lucrative business model for farmers. Until the late 1980s, Canadian tariffs on international products protected Canadian wines from direct market competition and kept prices for labrusca and hybrid grapes in Canada artificially high. This enabled labrusca and hybrid grape farms to remain more profitable during this period than they would have otherwise been under a purely market‐derived price structure.

Canada’s grape and wine industry during this time featured popular wines that were derived from labrusca and hybrid grapes, such as Moody Blue and the iconic Baby Duck. While some of the original wines of the old Canadian wine industry are still on the shelves today, the Free Trade Agreement (FTA) between Canada and the US in 1988 rang the death knell for the old Canadian wine industry by removing trade barriers to US product.

Among other changes that occurred in federal legislation in the industry shortly after the FTA, labrusca grapes were banned from use in the production of Ontario wine. This was because the market for sweeter high‐alcohol wines made from labrusca grapes had decreased dramatically by this time, while drier low‐alcohol wines made from European‐derived vinifera grapes had become far more popular in Ontario. To build a wine industry that could compete in the post‐FTA market, legislation was necessary to induce growers to change from a business model based on labrusca grapes to one based upon the increasingly popular vinifera grape. Meanwhile, the Canadian and Ontario governments sought to aid farmers in the midst of this government‐instituted industry change and implemented an extensive vine removal program throughout the 1989‐1993 period, wherein the federal and provincial governments paid farmers to remove their labrusca grape plantings. More than 8,500 acres of vines were removed through this program. As a result of these government‐instituted changes, farmers began to experiment in earnest with the cultivation of higher‐quality vinifera grapes.

Vinifera grapes include a number of high‐quality grape varieties that originated in Europe, including Sauvignon Blanc, Chardonnay, Pinot Gris, Merlot, Cabernet Sauvignon and Cabernet Franc, among others. While cultivation of these varieties was attempted in Canada during the 19th century, the presence of a serious grape pest, cold Canadian winters and late Canadian spring frosts resulted in significant damage/death to these vines, and the practice was abandoned. The FTA and the expanding Canadian market for high‐quality wines resulted in an earnest revisiting of the practice of cultivating vinifera grapes in Canada in a search for the economic viability of Canada’s wine industry in the post‐FTA economy.

As noted earlier, Canada’s climate is by and large not suited to the cultivation of cold temperature sensitive vinifera grapes. With few exceptions, Canada’s winters are far too harsh, resulting in high vine mortality rates in these varieties. One of the few areas in Canada with a climate more amenable to the cultivation of vinifera grapes is the Niagara Region of Ontario.

A small portion of the Niagara Region has a moderated climate that is highly influenced by Lake Ontario along its northern border. Meanwhile, the Niagara Escarpment is located along the southern edge of Niagara’s wine producing lands. These features of the topographical layout protect this unique area of land in two ways: the area receives warming breezes during winter from Lake Ontario, as it does not freeze over; and a northern slope from the escarpment to Lake Ontario slows vine development in the spring and reduces the risk of spring frost. Warmer air masses circulate between these geographic bodies from north to south, resulting in a convection effect in wind currents at and above ground level, which causes a moderating climatic influence on the affected area and moderates both summer and winter temperatures. This land area is quite small and somewhat pie shaped, extending some 40 km from east to west along the shore of Lake Ontario. The escarpment slope is furthest from Lake Ontario at its east end (approximately 10‐12 km). The affected area narrows towards the west end, where it is 1‐3 km wide. This climatically moderated area tends to have fewer incidences of ‐20 to ‐25C air temperatures than the areas above the escarpment to the south and other areas nearby. This temperature range is relevant to the area’s wine industry, due to the fact that it is generally considered to be the temperature at which significant damage and potential mortality can be caused to vinifera vines. In this article, the affected rural area will be referred to as the Study Area. Note that, while the above‐noted pie‐shaped area includes numerous urban and semi‐urban communities, the Study Area refers solely to the small amount of rurally‐located agricultural acreage within the affected area’s limits.

Of this rather small acreage, the area’s convection effect moderates certain portions of the Study Area more so than others. In areas where the convection effect moderates air temperature significantly, the climate is considered fairly suitable to the cultivation of vinifera vines, while those areas that receive less moderation (and lower temperatures, particularly during winter and early spring months) are considered less suitable. In the case of the latter, this is due to the fact that these pose higher risk when contemplating a parcel in that area for the cultivation of these plantings. Since the climatic areas affected by this convection effect are so small, the various areas are generally referred to as ‘meso‐climates.’

The cost to construct a vinifera vineyard was recently estimated at approximately $29,000 per acre, not including the cost of the land (as per 2009 figures from the Ontario Ministry of Agriculture Food and Rural Affairs). This figure also includes a four‐year waiting period until vines are generally considered to be near full maturity. Construction cost of a vineyard is therefore generally considered sizeable, running to over $1 million to plant 40 acres, for instance. Considering the differences in risk of winter damage and frost damage to vines across various locales within the Study Area, the financial risk to farmers in the cultivation of vinifera grapes can vary greatly between locations that are merely a few kilometres apart. Bud damage caused by winter cold or spring frost can result in a waiting period of one year until the damaged portion of the vine is again producing; more significant damage can result in the vine needing to be cut to its base or removed altogether with a new vine being replanted, resulting in a waiting period of 3‐4 years until the vine is near full production. Thus, between 1989 and 1993, a unique real estate market appeared in Ontario in the Niagara Region – one whose market values were based predominantly on climate as opposed to development potential, proximity to urban centres, or even soils.

Figure 1 is a map of the area affected by Niagara’s convection effect, i.e., the Study Area. It is based upon the climatic map entitled Site Selection for Grapes in the Niagara Peninsula, originally generated by the Ontario Ministry of Agriculture and Food in 1976, last revised in 2009, with some additional illustrations introduced for the sake of discussion. Zones A to D in the Study Area are located in the Town of Lincoln, while Zones 1, 2 and 3 are located in the Town of Niagara‐on‐the‐Lake. In Lincoln, two of the zones are well‐moderated: Zone A, located in close proximity to the moderating influences of the Lake Ontario shore; and Zone D, located along the ‘Bench’ of the Escarpment, where cold air travels quickly down the gently sloping land along the Escarpment face, to rest further north on more level land.

In the second part of this article, Zone D has been broken down into two areas – Zone D‐West and Zone D‐East, due to the fact that, although these areas are fairly consistent climatically, trends in unit values in the west end of Zone D have differed greatly from those in the east end of the zone throughout the study’s timeframe. Meanwhile, Zones B and C have less moderation, but may still be suitable in some instances: specifically, Zone C, generally having a slight downward grade to the north, usually is somewhat superior to Zone B, which tends to have more level topography with cold air tending to rest in this area. Of the zones in Niagara‐on‐the‐Lake, Zone 1 is generally considered to be well‐moderated (being located in close proximity to the moderating influences of the Lake Ontario shore), while Zones 2 and 3 have less moderation, but may still be suitable in some instances. The entirety of the Niagara‐on‐the‐Lake portion of the Study Area tends to have fairly level topography.

This article studies the trends in land values in the Study Area during the first 24 years of a new, somewhat experimental Canadian industry. The study explores trends in values for land purchased for the cultivation of wine grapes from the date of the reinvention of the Niagara grape and wine industry in 1989 (shortly after the passing of the FTA) until the end of 2012. All sales of vacant agricultural land within the Study Area were considered in the analysis; however, only those sales of parcels with an estimated highest and best use of planting to grapes were used.

*******************************

To estimate highest and best use of an agricultural parcel within the Study Area, analysis of the applicable parcel size was completed. Parcels within the Study Area usually tend to be quite small, relatively speaking in the national realm. Within the Study Area, a one‐acre parcel on which a rural residence may be constructed will tend to have a high unit value per acre. Thereafter, the value per acre of a parcel will usually decrease in inverse relation to its size, assuming consistent location, soils, topographical attributes and the ability to construct a rural residence. Except for throughout Zone 3, at around the 15‐acre point, values per acre tend to level off (again, assuming consistent soils/location/topographical features); from this point onwards, parcel size has little effect on the unit value of a parcel in the Study Area. Thus, only parcels of 15 or more arable acres were included in the study in all areas except Zone 3, if the parcels were considered legal for the construction of a single family residence.

Meanwhile, in Zone 3, the low agricultural unit values in this area throughout the study’s timeframe resulted in values levelling off at around the 25‐acre point; therefore, in Zone 3, only parcels having approximately 25 or more arable acres were included in the study. As well, a few sales of parcels with smaller acreage that were zoned for agricultural purposes only (i.e., construction of a single-family residence was not permitted on the lands) were also included in the sales data due to the quite consistent unit values found between these sales and aforementioned buildable parcel sales.

The next step in estimating highest and best use consisted of analyzing the parcel’s soils. Vinifera grapes can grow on the variety of sandy loam, silty clay loam, clay loam and heavy clay soils within the Study Area. It should be noted that vinifera vines do not tend to have any issues in attaining the area’s generally agreed‐upon productivity on most of the Study Area’s soil types. Only the area’s heavy clay soils may result in productivity that is below the local industry’s standard – these heavy clay soils are found only in portions of Zone 3. Soil stoniness does not tend to be a factor in the Study Area, nor does parcel topography, as the greater portion of the Study Area has fairly level topography, while those areas considered suitable to planting on sloped areas had been cleared for agricultural use prior to the study’s time frame.

The third step in estimating highest and best use of an agricultural parcel within the Study Area consisted of disqualifying agricultural parcels from the study that were considered to have had a different highest and best use than that of planting to grapes as of the time of sale. The wine industry in Niagara has historically competed for agricultural land in the Study Area with the peach industry; thus, an alternative highest and best use of the land that required contemplation was planting to peaches. Peach and nectarine plantings tended to be quite lucrative throughout most of the study’s time frame.3

Meanwhile, only parcels with very sandy soils were considered suitable for the cultivation of peaches in the Study Area. The lucrative nature of this industry, coupled with the limited supply of land suitable to this use, resulted in parcels considered suitable to the cultivation of peaches and nectarines generally selling for unit values greater than those lacking these sandy soils, during the greater portion of the study period. Therefore, throughout the study period, sales of parcels with sandy loam soils that were purchased for cultivation to peaches and nectarines within the Study Area were considered to have a different highest and best use than planting to grapes, and were not included in the dataset. If the writer became aware of a parcel having sandy soils that was purchased for the cultivation of grapes, it was included in the dataset.

The wine industry in Niagara also shares the market for agricultural land in the Study Area with the greenhouse industry. The Study Area has historically been considered conducive to the construction of greenhouse space due to its moderated climate (which lowers energy costs), its close proximity to Toronto, and its close proximity to the US. Soils are generally not a considerable issue in the decision‐making process of buying a greenhouse site, unless ground crops are part of the business plan proposed by the prospective greenhouse operator. However, quasi‐commercial exposure can result in increased commercial visibility and easier accessibility, and can increase the unit value paid for a greenhouse parcel. Therefore, parcels with good quasi‐commercial exposure that were purchased for the construction of a greenhouse in the Study Area were not included in the dataset.

The selection of a winery site can also benefit from quasi‐commercial exposure. Such exposure can increase commercial visibility, prestige and on‐site sales. This can result in substantially higher unit values paid for these sites. Inclusion of parcels with good quasi‐commercial exposure in the dataset would have unnecessarily skewed the study’s results. Therefore, any sales of parcels with such exposure that were purchased for the construction of a winery were not included in the dataset.

Thus, when all of the sales of vacant agricultural parcels that had taken place during the 1989‐2012 timeframe within the Study Area were considered according to the above‐noted parameters, 101 sales were included in the dataset. The parcels in the dataset range in size from 2.12 to 98.96 acres, with most of the sales being in the 15 to 98.96 acre range.

The study takes into consideration typical vendors and purchasers in the marketplace. Key players in the Niagara wine industry tend to be the following: farmers wanting to expand or contract their existing farmland holdings; existing winery owners wanting to do likewise with their existing farmland holdings; and investors looking to either build a winery4 or invest in land. The ‘investor’ component of this market includes investors from throughout Ontario and those from other parts of the world, and includes both individuals and investing partnerships.

From this point in the study’s methodology, adjustments were made to the sales included in the dataset for non-arable land. This is due to the fact that, in this market throughout the study period, non‐arable land is generally considered to have significantly lower utility than arable land, with vendors and purchasers in the marketplace taking the lower utility of these lands into account when negotiating sale prices. In particular, Zone D in Lincoln includes a substantial amount of non‐arable, heavily treed ravine land.

Adjustments were made based upon sales of similar‐type non‐arable land in the Study Area on which no residence could be constructed (in other words, the utility of these lands consisted solely of recreational and environmental use). In a couple of instances, adjustments were made for small amounts of acreage planted to vinifera vines, based upon the market‐derived contributory value of the vines. In one instance, an adjustment was made for a small residence, based on the market‐derived contributory value of this residence.

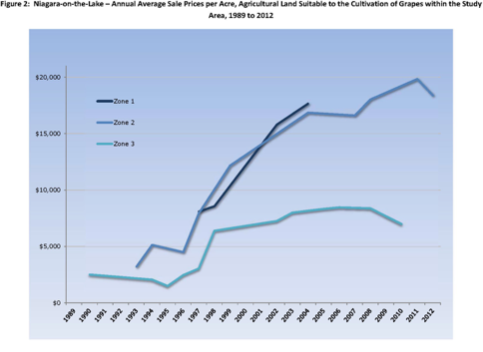

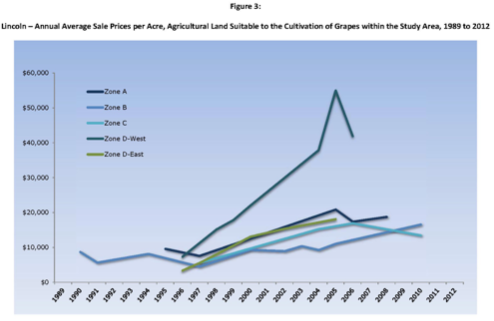

From this point, the weighted mean sale price per acre for each Zone in each year of the study period was derived using the aggregate of the adjusted sale prices paid in the year in each Zone divided by the aggregate number of acres sold in that Zone during the year. Throughout the remainder of this article, the weighted mean is referred to as the average annual sale price per acre. The average annual sale prices per acre in the Study Area’s various zones are shown in the charts in Figures 2 and 3, which reference the portions of the Study Area located in Niagara‐on‐the‐Lake and Lincoln respectively.

Thus, the study explores the reinvention of the Niagara wine industry and its effect on agricultural vacant land values within the Study Area throughout the 24‐year history immediately following the FTA. The results of the study follow roughly five stages: 1989 to 1993, 1994 to 1997, 1998 to 2002, 2003 to 2008, and 2009 to 2012.

1989 to 1993

1989 to 1993 is chosen as the first study period due to the fact that the aforementioned vine removal program ended in 1993; therefore, during the entirety of this period, the grape industry is considered to have been in an early state of transition. During this period, the market for labrusca and hybrid grapes was significantly oversupplied. Very few sales of land suitable to the cultivation of grapes were noted during this time, with sale prices running from $2,500 to $8,500 per acre in the Study Area. The lowest rate of around $2,500 per acre was noted in the somewhat climatically‐moderated Zone 3 of Niagara‐on‐the‐Lake, while parcels in the somewhat climatically‐moderated area of Zone B in Lincoln sold at approximately $5,500 to $8,500 per acre. Unit values remained fairly consistent during this period – it appears that market participants had been recognizing an oversupply in the labrusca and hybrid grape market for some time, while the potential net incomes from vinifera grapes had not yet been recognized in the market. Meanwhile, Niagara winery growth was also in its early stages. Prior to 1989, approximately 10 wineries were in existence; throughout this period, another seven were opened, with 17 in existence by 1993.

1994 to 1997

From 1994 to 1997, the number of land sales increased, although the only substantial increase in unit values took place in the somewhat moderated area of Zone 2 in Niagara‐on‐the‐Lake. This area saw unit values more than double as the average unit value of approximately $3,000 per acre in 1993 rose to nearly $8,000 per acre by 1997. During this period, the potential for revenue generation through vinifera planting was becoming more widely recognized. An increase in the number of land sales over the previous period was noted in almost all of Niagara’s vinifera‐growing areas. Two of the coldest climate zones in the Study Area (Zone B in Lincoln and Zone 3 in Niagara‐on‐the‐Lake) had somewhat lower unit values than more moderated areas, for the most part. Also, one of the most moderated climate areas, Zone D (including both Zones D‐West and D‐East as illustrated in Figure 3), being the generally termed the ‘Bench’ area in Lincoln, had unit values that were fairly consistent with those throughout the remainder of Lincoln. This is due to the fact that, prior to the reinvention of the wine industry, while the Bench area was thought to be scenic, it was considered to have limited revenue potential from an agricultural standpoint, as a result of its silty loam soils, sloping/rolling topography, and prevalence of non‐arable ravine area. Winery start‐up was quite slow‐moving during this period, with only five wineries having started from 1994 to 1997.

1998 to 2002

1998 to 2002 saw substantial expansion in the area’s wine industry, with 25 wineries opening their doors. Scarcity of land and recognition of potential revenue from the reinvented wine industry acted to drive prices up significantly. The increases were fairly consistent in all of the study’s zones that had sales occurring throughout this time period. Zone 1 in Niagara‐on‐the‐Lake, being considered to have some of the best‐moderated meso‐climates in the Study Area, almost doubled in unit values, with an average unit value of approximately $8,000 per acre in 1997 rising to almost to $16,000 per acre in 2002. Unit values in Zone B in Lincoln, considered one of the less‐moderated meso‐climates, experienced a significant rise in unit values between 1997 and 2000, with rates remaining at this level thereafter, after having had fluctuating unit values throughout the previous periods. Likewise, Zone 3 in Niagara‐on‐the‐Lake, considered one of the less‐moderated meso‐climates during this timeframe, experienced a dramatic increase in unit values. In 1997, the average unit value in Zone 3 was approximately $3,000 per acre; by 2002, this rate had more than doubled. Meanwhile, the greatest rise in unit values was experienced in Zone D. Unit values in Zone D‐West tripled between 1996 and 2000.

While having previously been considered a scenic area with limited agricultural revenue potential due to its topography, soils and prevalence of non‐arable bush‐covered land, this area had become the location of numerous wineries in a fairly small area, which increased the level of prestige in the area. Likewise, while Zone D‐East did not have the prevalence of wineries, this area also saw unit values triple between 1997 and 2002, due to its highly climatically‐moderated Bench locale. Thus, during this timeframe in the study, market participants were pushing prices of land considered suitable to this industry upwards at a brisk and consistent rate throughout all of the Study Area’s various zones. The dataset indicates that, throughout this period, the market’s perception of utility throughout the entire Niagara vinifera‐growing region was rising quite dramatically.

2003 to 2008

Substantial change in the wine industry land market began during the spring of 2003, when it became apparent that a few very cold nights during the previous winter had resulted in the area industry’s first substantial cold‐derived crop loss. While some parcels received only vine bud damage, others suffered greater vine damage, some to the point of necessitating vine replacement. This was a significant blow to the young Niagara vinifera wine industry. Bud damage meant waiting until the following year for a crop. Vines with substantial damage at times had to be cut back to the base of the plant’s stem, with a waiting period of 3‐4 years until the vines would be back in full production. Vine replacement meant waiting a full 4‐5 years until new vines would be in full production. A few enterprising parcel owners purchased and installed wind machines on their parcels, at an initial cost of $30,000‐35,000 each, not including operating costs. Although the presence of a wind machine could lower the potential of winter damage for an area of anywhere from 5-15 acres, the fact that this was the first year of substantial winter damage in the history of the reinvented industry resulted in many vineyard owners being somewhat reticent about purchasing this equipment. The Niagara wine industry had had the first of its widespread ‘growing pains,’ and was developing some hard‐won maturity. Therefore, in the spring of 2003, approximately 15 years after the reinvention of the industry, the level of knowledge in the market regarding climatic location risk increased.

Then, during the late winter of 2004‐05, nights even colder than those of the 2002‐03 winter resulted in more substantial damage. This time, the crop loss experienced due to the winter damage was devastating. In total, the 2005 provincial overall yield of processed grapes declined 54% in 2005 versus 2004, mainly due to winter injury of the province’s ±10 million vines at the time.5 The Niagara Region suffered its fair share of the devastation.

The sales statistics indicate that, during the 2003‐08 time period, unit values continued to rise in most of the Study Area’s zones (excepting Zone D‐West in Lincoln) at much slower rates than during the previous time frame. This was likely due in part to the high levels of vine winter damage, which occurred in 2002-03 and 2004‐05. In Niagara‐on‐the‐Lake, the greatest amount of damage after these winters was found in Zone 3. Prior to these two winters, Zone 3 had been considered by many market participants to be a fairly viable location for the cultivation of sensitive vinifera grapes; this reasoning had been reflected in dramatically rising unit values throughout the 1997‐2002 period. However, this area was considered less viable after the damage of these winters, due to the fact that the greatest amount of crop/vine loss had occurred in this Zone. The statistics indicate that, while Zone 2 (located adjacent to Zone 3) continued to rise in unit values per acre throughout the 2003 to 2008 period, unit values in Zone 3 rose at a slower rate. As a result, the difference in attainable unit values between these two zones became even more substantial than had previously been the case. Meanwhile, land values continued to rise fairly steadily throughout most of Lincoln during this time period, with the exception of Zone D‐West (the westerly area of the Bench), which experienced a further near‐doubling in its unit values from the prior period. The significant rise in the Zone D‐West area during this time period was due to the fact that the Niagara wine industry was continuing to mature, with market demand for parcels with well‐moderated climatic locations continuing to be good, and the fact that supply of land available for the planting of grapes in this now‐prestigious locale had diminished substantially, with vacant arable land rarely being available in this area by 2005. Meanwhile, sales in Zone B indicate around a 20‐25% rise in unit values from 2002 to 2005, with this trend continuing thereafter. Likewise, sales in Zone D‐East indicate a 15-20% rise from 2002 to 2005. Interestingly, the data indicates Zones A and C as having more than doubled between 1997 and 2004/2005, although the greatest amount of this increase may have occurred during the 1998‐2002 period, with the jump not being evident until 2004/2005 due to lack of sales in these areas during the earlier period. Overall, the trend lines indicate fairly consistent rises in unit values throughout this period in all of Lincoln’s zones excepting Zone D‐West.

As a result of the significant vine and bud damage that had occurred throughout the Niagara Region in the winters of 2002‐03 and 2004‐05, the installation of wind machines throughout the Study Area became much more prevalent. It is considered likely that, if the technological advance of wind machines in the reinvented Niagara wine industry had not taken place, winter cold risk would have had greater impact on unit values in the Study Area in the long term. In addition, the winter damage in 2002‐03 and 2004-05 reportedly caused industry participants to redouble efforts at developing better farming practices. This aided in increasing vinifera farm profitability, and also most likely helped to buoy unit values.

2009 to 2012

During the most recent period of 2009 to 2012, a more mature land market was exhibited for the Niagara wine region, with land prices rising somewhat in Lincoln’s Zone B and Niagara‐on‐the‐Lake’s Zone 2, while decreases were noted in Lincoln’s Zone C and Niagara‐on‐the‐Lake’s Zone 3. However, during this period, there were some motivated vendors entering the market, due in part to the closing of the area’s cannery in 2008 (this had been Canada’s only fruit cannery east of British Columbia) and the receivership of a large cooperative winery in the area during the same year. This likely was, at least in part, the cause of the variability in land prices during this period. In Lincoln, lack of supply of unplanted land along the west end of the ‘Bench’ resulted in no sales in Zone D‐West during this time period.

Conclusions of the study

The government‐instituted changes in Canada’s wine industry that occurred from 1988 to 1993 had a significant impact upon vendors and purchasers in Niagara’s Study Area agricultural marketplace. While market perceptions evidently took time to evolve after these initial changes, they resulted in significant changes in attainable rates per acre of land in this particular market. During 1989 to 1993, this market was fairly stagnant, with few sales taking place. During the period 1994 to 1997, while a greater number of sales took place, a substantial rise in unit values was only noted in one of the Study Area’s zones. Increasing momentum in the upward trend occurred in all of the Study Area’s zones throughout the 1998 to 2002 period, due to significant expansion of the industry and rising market player perceptions in all of the zones regarding anticipated rewards of purchase. The winter damage caused in 2002‐03 and 2004‐05 brought to light the actual level of climatic risk for the reinvented Niagara wine industry. This risk had reportedly been known by market players in the pre‐FTA grape and wine market. However, the risk had evidently been forgotten by those swept up in buying lands in the reinvented Niagara wine industry, due in part to the fact that new market players were involved in the post‐FTA market that had yet to experience a Niagara winter with severe winter damage. The dramatic events during these two winters led to two technological advancements in the market‐market recognition of the necessity of wind turbines and the development of better agricultural practices in the industry. Both of these advances have aided economic viability in this market since that period. Thus, this study brings to light the effects that changing market knowledge and technologies in the marketplace can have upon agricultural land values.

This study is also interesting with regard to an analysis of highest and best use and its effect upon marketability of a parcel in the marketplace. While this point is evident throughout the study’s dataset, it can be brought home particularly in the case of Zone D‐West. Prior to the reinvention of the Niagara wine industry, highest and best use of much of the agricultural land throughout the entirety of Zone D was considered to be cultivation to tree fruit (apples, plums, pears) or labrusca/hybrid grapes. The reader notes that fairly typical unit values were indicated throughout this zone in 1996/1997, a number of years after the reinvention of the Niagara wine industry. As the wine industry gained steam, it became recognized that the Bench area had some of the best climatic conditions in the Study Area for lessening the damage/mortality risk to vinifera vines, and predominantly silty clay loam soils that were quite conducive to the cultivation of these vines. Thus, unit values of arable land rose more quickly throughout Zone D than any other zone in the Study Area from 1996-97 to the end of the 2002 time frame. Meanwhile, scarcity became an issue in Zone D‐West to further drive unit values upward. Strong demand for land in Zone D‐West, driven by a combination of the suitable climate and soils, aesthetic appeal and prestige (caused by the prior location of numerous wineries in this small area) in this area, resulted in a lack of land supply, which drove unit values even higher. As of 2012, Zone D‐West was the location of the highest unit values paid for agricultural land in the Study Area.

The study also underscores the effect that government legislation can have upon the highest and best use of agricultural land. Prior to the FTA, prices attainable for labrusca and hybrid grape varieties were high enough due to government‐legislated protective trade barriers that planting to labrusca and hybrid grapes was often considered as a highest and best use of the land in the Study Area. However, with the advent of the FTA and resulting disallowance of labrusca grapes from Ontario wine, prices for the Study Area’s labrusca/hybrid grapes plummeted. As a result, the market was forced to look to alternative highest and best uses of agricultural land in the Study Area. This resulted in the reinvention of the Niagara wine industry using vinifera grapes.

The study also brings to light the fact that, when appraising property in agricultural real estate markets, the appraiser must be aware of the bases upon which players in the marketplace form opinions of value. At the base of determined highest and best use of a sold agricultural parcel in the Study Area was the question of perceived economic viability of the parcel to a particular proposed use, as of the date of sale. This is fairly typical of many agricultural markets in southern Ontario. In other words, in the contemplation of an agricultural land purchase, the potential purchaser asks whether or not the parcel is economically viable for a particular contemplated use, as of the effective date. This question in many agricultural real estate markets across Ontario is often answered by the analysis of soils, climate, proximity to markets or urban areas, among other factors. In the case of the Study Area’s market, climate, parcel size and scarcity were the most determining factors.

It is the appraiser’s responsibility to appropriately analyze the underlying forces affecting value in the marketplace when appraising an agricultural property. This study highlights the fact that, when changes occur in the marketplace as a result of changes in market knowledge, technology, government legislation or supply/demand, the appraiser must take these issues into account in the analysis of the market, as of the effective date of the appraisal.

End notes

1 Statistics Canada, Census of Agriculture, 2006

2 Industry Facts, Grape Growers of Ontario website, August 2014

3 Peach plantings have been considered lucrative in the Niagara area over the greater portion of the study’s time frame. However, in 2008, the sole fruit canning plant in Canada east of British Columbia, located in the Village of St. David’s in the Town of Niagara‐on‐the‐Lake, shut down. This resulted in a reported ±150 farmers in Niagara losing their sole buyer for their processing peaches and pears. This resulted in a significant amount of peach and pear plantings being pulled out due to the fact that they were no longer considered economically viable, after which some of the vacant land was reportedly replanted to grapes. If the writer became aware of a sale of a parcel that was formerly planted to processing peaches and purchased for the cultivation of grapes, it was included in the study. However, sales of this type were considered minimal during the study period.

4 Winery locations with good quasi‐commercial exposure were not included in the dataset. Only sales of winery locations with no quasi‐commercial exposure component were included.

5 H. Fraser, K. Slingerland, K. Ker, K.H. Fisher, R. Brewster, Reducing Cold Injury to Grapes Through the Use of Wind Machines, Final Report (2009), p. 1.